On This Page

Recent Revisions to This Document

26.02.02

- New Adobe Commerce Open Source Plug-in

- A new Adobe Commerce Open Source plug-in was added to augment the existing Adobe Commerce Cloud plug-in. See Adobe Commerce REST API.

- Github link

- Added a link to ISV Toolkits available at GitHub. See About the Integrated Solutions.

- Adobe Commerce Cloud

- Updated the section on configuring web services to refer to a change in the procedure where SOAP p12 certificates are uploaded to a section now called Simple Order P12 Key File. See Configuring WebService.

- Updated the section on creating a SOAP security key to refer to the SOAP P12 certificate. See Configuring Security Credentials.

- PrestaShop

- Revised the PrestaShop section. See PrestaShop.

- Shopify

- Added note to the configuring section to ensure that the Test mode is used when testing. See Configuring Shopify.

- The testing section was revised to describe how to install and use a new test app. For more information, see Reference Information.

- WooCommerce

- Updated the WooCommerce plug-in. For more information, see WooCommerce.

25.12.01

- Oracle Netsuite

- Removed Oracle Netsuite module from guide.

25.10.01

- Shopify

- Added note that when using the test server, ensure that the Test Mode option is enabled. See Configuring Shopify on page 122.

- WooCommerce

- Added note to the troubleshooting section to check with support services for configuration guidance when your account is managed by a merchant services provider. See Support and Troubleshooting on page 129.

25.09.02

- PrestaShop

- This revision contains only editorial changes and no technical updates.

- Shopify

- The app now supports Shopify subscriptions.

- Clarified that during installation, you use the transacting merchant ID as your credentials. See Installing the Live App.

25.09.01

This revision contains only editorial changes and no technical updates.

25.08.01

- WooCommerce

- Updated all information in this section. See WooCommerce.

VISA Platform Connect: Specifications and Conditions for

Resellers/Partners

The following are specifications and conditions that apply to a Reseller/Partner enabling

its merchants through

Visa Acceptance platform

. Failure to meet any of the specifications and conditions below is

subject to the liability provisions and indemnification obligations under

Reseller/Partner’s contract with Visa/Cybersource.- Before boarding merchants for payment processing on a VPC acquirer’s connection, Reseller/Partner and the VPC acquirer must have a contract or other legal agreement that permits Reseller/Partner to enable its merchants to process payments with the acquirer through the dedicated VPC connection and/or traditional connection with such VPC acquirer.

- Reseller/Partner is responsible for boarding and enabling its merchants in accordance with the terms of the contract or other legal agreement with the relevant VPC acquirer.

- Reseller/Partner acknowledges and agrees that all considerations and fees associated with chargebacks, interchange downgrades, settlement issues, funding delays, and other processing related activities are strictly between Reseller and the relevant VPC acquirer.

- Reseller/Partner acknowledges and agrees that the relevant VPC acquirer is responsible for payment processing issues, including but not limited to, transaction declines by network/issuer, decline rates, and interchange qualification, as may be agreed to or outlined in the contract or other legal agreement between Reseller/Partner and such VPC acquirer.

DISCLAIMER: NEITHER VISA NOR CYBERSOURCE WILL BE RESPONSIBLE OR LIABLE FOR ANY ERRORS OR

OMISSIONS BY THE

Visa Platform Connect

ACQUIRER IN PROCESSING TRANSACTIONS. NEITHER VISA

NOR CYBERSOURCE WILL BE RESPONSIBLE OR LIABLE FOR RESELLER/PARTNER BOARDING MERCHANTS OR

ENABLING MERCHANT PROCESSING IN VIOLATION OF THE TERMS AND CONDITIONS IMPOSED BY THE

RELEVANT Visa Platform Connect

ACQUIRER. About the Integrated Solutions

Visa Acceptance Solutions

offers integrated solutions to enhance payment acceptance,

fraud management, recurring billing, reconciliation, and reporting processes. Our

integrated solutions provide significant and vast use cases for product managers to

developers and business professionals. Reduce your operational costs through streamlined

payment integrations and improve customer satisfaction through flexible and secure

payment options. Our solutions can easily scale to your growing business needs, help

increase sales and conversion rates, and provide a clear value proposition to

distinguish your business from competitors.The solutions detailed in this document are:

For information on how to become a partner, see the

Partner Getting Started

guide. See

these additional resources for more information about the ISV Plugins documented in this

guide:

Built by Us

Welcome to

Visa Acceptance Solutions

's suite of solutions built by Visa Acceptance Solutions

for you. These solutions offer potential use cases that improve

operational efficiency, enhance security, and provide comprehensive reporting and

invoicing. Reduce the risk of errors, protect against fraudulent transactions, and

ensure accurate financial records through streamlined reconciliation processes. Our

solutions are ideal for various industries including financial services, healthcare,

manufacturing, and distribution. For example, in healthcare, our solutions can manage

payment operations efficiently, ensuring secure and accurate processing of payments for

services rendered, and support timely invoicing actions.These guides are created by

Visa Acceptance Solutions

:Adobe Commerce REST API

The Visa Acceptance Solutions extension for

Adobe Commerce

/Magento

Open Source enables merchants to connect their Adobe Commerce

/Magento Open Source store to the Visa Acceptance Platform to directly take credit and

debit cards, Apple Pay, Google Pay, and Click to Pay payments.For simplicity in this document, any reference to

Adobe Commerce

will

apply for Magento Open Source also, unless otherwise stated.Supported Features

The Visa Acceptance Solutions extension supports various payment methods and security features.

Payment Methods

- Credit/debit cards

- Apple Pay

- Google Pay

- Click to Pay

Security Features

- Payer Authentication/3-D Secure

- Tokenization

Supported Versions

The

Adobe Commerce

extension has these system requirements:- Adobe Commerce2.4.5+

- PHP 8.1+

Unsupported Adobe Commerce Features

Adobe Commerce

FeaturesThese features are not supported by this extension:

- Order void

- Multi-shipping

- Multiple node implementation

- Google reCAPTCHA

Visa Acceptance Solutions Prerequisites

Mandatory Prerequisites

This Visa Acceptance Solutions product must be configured for your Merchant ID:

- Unified Checkout

You also must have a REST Shared Secret Key. See the Getting Started with REST Developer guide

for information on how to get a REST Shared Secret Key.

Optional Prerequisites

These Visa Acceptance Solutions products are optional. If you want these products you

must enable and configure your Merchant ID with them.

- Payer Authenticationfor3-D Secure

- Tokenization

- Apple Pay

- Google Pay

- Click to Pay

You can also enable Message-Level Encryption (MLE) for additional security. A REST Certificate is required for MLE.

Release Notes

Version history and changes for the Visa Acceptance Solutions extension for

Adobe Commerce

.Version 25.2.0 January 2026

These enhancements were added with this release:

- Request Message Level Encryption

- API endpoint updates

- Support for Jaywan card

- Implemented Sub Resource Integrity (SRI)

- UpdatedUnified Checkoutto version 0.33

These bugs were addressed in this release:

- Corrected the country field source in theUnified Checkoutcapture context.

- CSP violation

This release is compatible with:

- Adobe Commerce2.4.5+

- PHP 8.1+

Version 25.1.0 May 2025

Initial release that supports:

- Unified Checkout

- Apple Pay

- Google Pay

- Click to Pay

- TMS

- Payer Authentication

This release is compatible with:

- Adobe Commerce2.4.5+

- PHP 8.1+

Installation

Follow these steps to install the Visa Acceptance Solutions extension for

Adobe Commerce

. Before starting the installation, ensure you have

Adobe Commerce

authentication keys and that they are set

correctly in your environment. See Authentication Keys for details.Go to the

Adobe Commerce

Marketplace and get the free extension.Choose the appropriate installation method based on your environment:

- Adobe Commerce Cloud: For cloud-based installations, go to the Adobe Commerce Cloud.

- Adobe CommerceOn-Premise / Magento Open Source: For self-hosted installations, go to Adobe Commerce On-Premise.

Adobe Commerce Cloud

Adobe Commerce Cloud

Follow these steps to install in

Adobe Commerce Cloud

environments.- Run this command in your local Cloud project directory:composer require Cybersource/module-payment:25.2.0

- After Composer finishes, commit the updated files using these commands:git add composer.json composer.lock git commit -m "Add Cybersource Payment module" git push

- Enable the module with this command:php bin/magento app:config:dump

- After enabling the module, commit the updated configuration file with these commands:git add app/etc/config.php git commit -m "Enable Cybersource> Payment module" git push

Adobe Commerce On-Premise / Magento Open Source

Adobe Commerce

On-Premise / Magento Open SourceTo install the module using Composer, run these commands in your

Adobe Commerce

On-Premise and Magento Open Source environments.php bin/magento module:enable Cybersource_Payment php bin/magento setup:di:compile php bin/magento indexer:reindex php bin/magento setup:upgrade php bin/magento setup:static-content:deploy -f php bin/magento cache:clean php bin/magento cache:flush php bin/magento module:status

Configuration

To configure the Visa Acceptance Solutions extension, go to . Configure these fields:

Configure General settings

: - Environment:

- Test: Choose for testing of yourVisa Acceptance Solutionstest account.

- Production: Choose for live transactions.

- Merchant ID: Enter the transacting Merchant ID (MID) assigned to you by Visa Acceptance Solutions.

- API Key: Enter the Key from your REST API Shared Secret Key.

- API Shared Secret Key: Enter the Shared Secret from your REST API Shared Secret Key.

- Accepted Card Types: Choose the card brands you want to accept.

Configure Debug Mode

: - Yes: Compiles detailed logs for every transaction. This option is only recommended for the Test Environment or when troubleshooting issues in Production.

- No: Only basic logging occurs.

Configure Message Level Encryption

:

Enabled

- Yes: Encrypts the full request message using JSON Web Tokens before being transmitted to the Visa Acceptance Platform.

- No: Uses the HTTP Signature.

JSON Web Tokens use a digital certificate to prove who you are, while HTTP

Signature uses a shared secret key to confirm the message is genuine. Both methods

are PCI compliant.

- Certificate File: Upload the p12 certificate for yourVisa Acceptance SolutionsMerchant ID.

- Key Password: Enter the password that was used when you created your p12 certificate.

Configure Secure Payment Methods

: - Enable: ChooseYesto enable the extension.

- Title: Enter the label your customers see on the checkout page.

- Payment Action: Choose one of these options:

- Authorize and Capture: Captures the transaction automatically when the authorization is approved.

- Authorize only: Sends an authorization request and if approved, you must manually request a capture.

- Payment Card Types: Choose the card brands you want to offer to your customers.

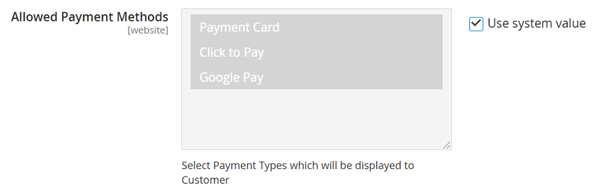

- Allowed Payment Methods: Choose the payment methods you want to offer to your customers. These payment card types must be enabled for your MID in theBusiness Center. See here for details.

- Select Layout:

- Embedded: The payment widget appears inline on the checkout page.

- Sidebar: The payment widget appears on the right side on the checkout page.

- Payment from Applicable Countries:

- All Allowed: Uses theAdobe Commerceglobal settings to determine which countries are available.

- Specific Countries: Specify which countries you want to accept payments from.

- : ChoosePayer Authentication/3-D SecureYesto enable3-D Secure.

- Tokenization: ChooseYesto enable your customers to save their payment cards for future purchases.

- Tokenization Title: Enter the label you want your customers to see when they pay with a saved card.

- Saved Card Verification: ChooseYesto request that your customer enter their card security code when paying with a saved card.

- Enforce Strong Customer Authentication: ChooseYesto enforce a3-D Securechallenge when a customer saves their card for the first time.

Order Management

The Visa Acceptance Solutions extension provides comprehensive order management

capabilities for handling transactions after they are processed. This includes capturing

authorized payments and processing refunds when necessary.

The order management features enable you to:

- Capture authorized transactions to collect funds.

- Process full or partial refunds for completed transactions.

- Manage the payment lifecycle from authorization to settlement.

Capture

When you have the

Payment Action

set to

Authorization

, you must capture the transaction to collect the

funds.- Enter an order from the list of orders.

- ClickInvoice.

- Check the item(s) that require capturing.

- Ensure the drop-down capture option is set toCapture Online.

- ClickSubmit Invoice.

Refund

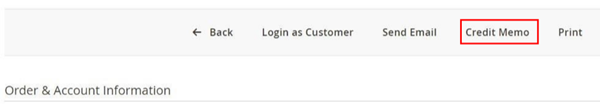

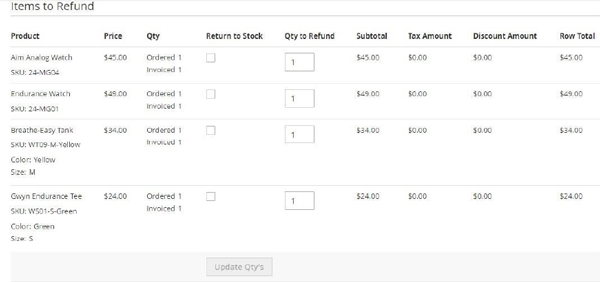

To refund an order:

- From the list of orders, choose the order you want.

- Click onInvoices.

- Select the appropriate invoice.

- Click theCredit Memobutton.

- Check the item(s) to be refunded.

- Verify and if necessary update theRefund Totals.

- ClickRefund.

Support & Troubleshooting

Get support for the Visa Acceptance Solutions extension by providing detailed information about your issue.

If you require support with this extension, sign into the Support Center to raise a case,

providing these details:

- Summary of the issue

- Steps needed to reproduce the issue

- Platform version

- Extension version

- Visa Acceptance SolutionsMerchant ID

- Configuration screenshots

- List of themes/additional extensions installed

- Log file and any other data or screenshots related to the issue

Upgrade

To upgrade from an earlier version of our

Adobe Commerce

extension, run these composer commands- Update the extension to the latest version:composer requireVisa Acceptance Solutions/module-payment:25.2.0

- Run the setup upgrade command:bin/magento setup:upgrade --keep-generated

- Deploy static content:bin/magento setup:static-content:deploy

- Clean the cache:bin/magento cache:clean

Adobe Commerce

Adobe Commerce

You can integrate

Visa Acceptance Solutions

with the Adobe Commerce

platform to process payments using Magento checkout. The Adobe Commerce

extension supports popular payment methods, safeguards

payment data, minimizes fraud, and mitigates risks. This section describes the payment

management capabilities offered by Visa Acceptance Solutions

through the Adobe Commerce

integration.This guide also applies to installing this extension in a Magento Open Source

environment.

Fraud Management

Fraud Management prevents fraud losses and gives you the flexibility to control

business practices and policies in real time. Fraud Management can help you

accurately identify and review potentially risky transactions while minimizing the

rejection of valid orders. Fraud Management comprises these capabilities:

- Real-time fraud screening performed only during authorization

- Device fingerprinting

- On-demand Conversion Detail Report for changes in order status

Account Takeover Protection

Account Takeover Protection defends customers and merchants from fraudulent use of

online accounts. It monitors suspicious account changes and helps identify high risk

users at account creation and login. These capabilities comprise Account Takeover

Protection:

- Real-time event screening of account creation, login, and changes

- Device fingerprinting

Payer Authentication

Payer Authentication enables you to add support to your web store for card

authentication services offered by Visa

, Mastercard,

and other card brands. These

programs verify the cardholder’s identity directly with the card-issuing bank in

real time to increase payment security and reduce the risk of fraud. However, Payer

Authentication is not a fraud management service, and Visa Acceptance Solutions

recommends that you configure a comprehensive fraud management program such as

Decision Manager

in addition to Payer Authentication services. These services

comprise Payer Authentication:- Verified by Visa

- Mastercard Identity Check

- American Express SafeKey

- Discover ProtectBuy

- JCB

- Diners

- Maestro International

To comply with the recent mandates for French local processors that support Payer

Authentication, CMCIC, Atos and BNP processors no longer support these

combinations.

PayPal

The

Adobe Commerce Cloud

integration includes the PayPal payment

method. Processing your PayPal transactions through Visa Acceptance Solutions

enables you to consolidate all payment types under a single gateway account,

simplify integration efforts, screen PayPal transactions for fraud with Decision

Manager, and streamline reporting. These services comprise PayPal:- Sessions

- Check Status

- Order

- Authorization

- Authorization Reversal

- Capture

- Sale

- Refund

- PayPal Credit

- Billing Agreements

PayPal Credit

PayPal Credit is a payment method that allows merchants to accept a PayPal

transaction when the customer chooses to finance their purchase through PayPal.

Electronic Check (eCheck Service)

eCheck

Service)The

eCheck

Service a form of digital payment that serves the same

function as a physical check. When a merchant accepts an electronic check payment,

the funds are pulled directly from the customer’s checking or savings account. These

are the eCheck

s include both debit and credit services.eCheck

Service process refunds with the credit payment

service.Online Bank Transfers

Online banking services enable customers to pay for goods by sending money from their

bank account to the merchant.

The

Adobe Commerce Cloud

extension supports the following payment

methods and corresponding online bank transfer services:- Bancontact

- Sale

- Check Status

- Refund

- Country: Belgium

- iDEAL

- Options

- Sale

- Check Status

- Refund

- Country: Netherlands

Tax Calculation

The Tax Calculation service provides real-time tax calculation during order checkout

for orders placed worldwide with your business.

Delivery Address Verification

The Delivery Address Verification service verifies the entered address and suggests

the recommended address for city, state, and zip code combinations in real time.

If this feature is enabled in the

Adobe Commerce Cloud

console, the

Adobe Commerce Cloud

extension verifies the delivery address on

shipping information updated by the user.Klarna

Klarna credit provides a seamless user experience for online customer financing to

merchants of all sizes, which helps in increasing customer choice, loyalty and

growth in sales.

Google Pay

Google Pay is a digital wallet that enables customers to pay with any payment method

saved to their Google account.

Release Notes

This section provides information about functionality, bug fixes, and enhancements for

the

Adobe Commerce Cloud

Visa Acceptance Solutions

integration.January 2026

- Adobe Commerce CloudVisa Acceptance SolutionsVersion 3.5.11 is compatible withAdobe Commerce Cloud: 2.4.8-p3, 2.4.8-p2, 2.4.8-p1, 2.4.8, 2.4.7-p8, 2.4.6-p13 and PHP 8.4, 8.3, 8.2

- Implemented Request Message Level Encryption

- Implemented Google Pay Payer Authentication

- Fixed Anonymous Script Load Error (Integrity and Cross Origin)

- UpdatedauthenticationStatusflag for Payer Authentication in Google Pay

August 2025

- Adobe Commerce CloudVisa Acceptance SolutionsVersion 3.5.10 is compatible withAdobe Commerce Cloud: 2.4.8-p1, 2.4.8, 2.4.7-p6, 2.4.6-p11,2.4.5-p13 and PHP 8.4, 8.3, 8.2, 8.1

- Extended support forAdobe Commerce Cloudv2.4.8.

- Changed path for certificate folder from root to var directory.

- Updated the certificate folder name to certificates.

April 2025

- Adobe Commerce CloudVisa Acceptance SolutionsVersion 3.5.9 is compatible withAdobe Commerce Cloud: 2.4.7-p4, 2.4.7-p3, 2.4.7-p2, 2.4.7-p1, 2.4.7, 2.4.6-p9, 2.4.5-p11 and PHP 8.3, 8.2, 8.1

- Upgraded Microform to v2.

- Implemented SOAP p12 Authentication.

- Remove legacy Click to Pay payment module.

- Fixed issue of declined cases and SCA transactions on Firefox browser.

June 2024

- Adobe Commerce CloudVisa Acceptance SolutionsVersion 3.5.8 is compatible withAdobe Commerce Cloud: 2.4.6 p3, 2.4.6 p2, 2.4.6 p1, 2.4.6, 2.4.5 p5, 2.4.4 p6 and PHP 8.2, 8.1

- Fixed Logger and CSP issue for Magento v2.4.7.

- PHP support added for v8.3.

- Removed unused class in Apple Pay.

- Added required field for Merchant ID in Back Store.

- Fixed issue for admin order redirecting to blank page.

- Made Payer Authentication common for both Secure Acceptance (Stored Card) and Soap Toolkit API.

- Fixed Visa Checkout error "No such cart entity id with cartid".

March 2024

- Adobe Commerce CloudVisa Acceptance SolutionsVersion 3.5.7 is compatible withAdobe Commerce Cloud: 2.4.6 p3, 2.4.6 p2, 2.4.6 p1, 2.4.6, 2.4.5 p5, 2.4.4 p6 and PHP 8.2, 8.1

- Removed zend dependency and replaced with laminas.

- Removed Payer Authentication Cardinal key dependency from Back Store Configuration.

- Google Pay and Apple Pay refund issue fixed for multiple websites.

- Apple Pay customer billing address fixes for downloadable and virtual products.

- The issue has been fixed for JSON error message in the 3-D Secure pop-up.

- Fixed invalid card type message that appeared in credit card Flex Microform.

- Added error message for Apple Pay session failure.

- Fixed Device Fingerprint raw parameter for Secure Acceptance.

- Fixed Payer Authentication failure scenario.

October 2023

- Adobe Commerce CloudVisa Acceptance SolutionsVersion 3.5.6 is compatible withAdobe Commerce Cloud: 2.4.6 p2, 2.4.6 p1, 2.4.6, 2.4.5 p4, 2.4.4 p5, and PHP 8.2, 8.1

- Implemented Direct Connection API Payer Authentication.

- Removed dependency onsales_order_gridtable for Google Pay and Secure Acceptance.

- Apple Pay order cancel fixes.

- PayPal billing address line 2 issue fixes.

- Removed parenthesis for http signature request-target in coreand.eCheckmodule

- Upgraded version for the lcobucci/jwt from 3.4.2 to 3.4.6.

May 2023

- Adobe Commerce CloudVisa Acceptance Solutions3.5.5 is compatible withAdobe Commerce Cloud: 2.4.6, 2.4.5 p2, 2.4.5p1, 2.4.4 and PHP 8.2, 8.1

- PHP support added for v 8.2.

- Compatibility withAdobe Commerce Cloudv2.4.6 – Changed few components of zend framework to laminas as per the latestAdobe Commerce Cloudchanges.

- Fixed bugs related to supported card types and sandbox/production issue in Apple Pay.

- Fixed jQuery deprecated functions.

February 2023

- Adobe Commerce CloudVisa Acceptance Solutions3.5.4 is compatible withAdobe Commerce Cloud: 2.4.5 p2, 2.4.5 p1, 2.4.x, 2.3.x

- New implementation foreCheckcron –EventStatus.

- Fixed bug related to Strong Customer Authentication.

- Removed required validation from reCAPTCHA fields.

- Updated Klarna library from credit to payments.

- AddedPaymentFlowModeas inline andPaymentMethodNameaspay_nowin Klarna app session request.

- Updated WSDL version to latest V1.206.

- Add new payment reject status asAUTHORIZED_RISK_DECLINEDfor Decision Manager reject.

Updating Adobe Commerce

Adobe Commerce

Follow these steps to update the

Visa Acceptance Solutions

bundle to the latest

version:- In your directory, navigate to theAdobe Commerceroot directory and find thecomposer.jsonfile.

- Open thecomposer.jsonfile and in theRequirefield, change the version to the latest version of the plugin.

- After you change the version in theRequirefield of thecomposer.jsonfile, run the composer update command.

Configuring Adobe Commerce

Adobe Commerce

Customer payments can be managed through the

Adobe Commerce

or the

Visa Acceptance Solutions Business Center

. This section describes the settings

you must configure in the Business Center

as well as some general use cases that

are typical in the day-to-day management of your Adobe Commerce

store. Contact Visa Acceptance Solutions for information about product availability and

enablment.You must complete all of the configuration tasks in order to use the features offered in

the

Adobe Commerce

Cybersource integration.Configuring Security Credentials

The module uses connection methods to access services that require their own security

credentials for authentication.

You must create and configure the SOAP toolkit key and REST API key for the

Adobe Commerce

to function properly.If you do not have a

Business Center

account, go to the

website to create an account. To activate your merchant account, follow the instructions

that are emailed to you. Then log in to the Business Center

to complete the

registration process. Be sure to store your merchant key ID for later use.Creating a SOAP P12 Certificate

The

Adobe Commerce

integration uses the SOAP Toolkit API to

access several services.Generate a SOAP P12 certificate from your

Business Center

account. For information on how

to create a SOAP P12 certificate, see Creating a SOAP p12 Certificate. Creating a REST API Key

The

Adobe Commerce

integration requires REST API key

creation to use some services like Flex Microform and the Fraud Management

report.From your

Business Center

account, you also need your merchant key ID

and shared secret key to enable the integration with Adobe Commerce

. For information on how to generate a shared secret

key, see . Be sure

to store your key ID and shared secret key for later use.Configuring Additional Backend Settings

Some services supported on

Adobe Commerce

require additional backend

setup on your Business Center

account. Contact your Visa Acceptance Solutions

account representative

to enable any of these services:- Payment Tokenization: Required by the module for credit card processing

- Decision Manager

- Payer Authentication

- PayPal Express Checkout

- eCheckService

- Online Bank Transfers

- Tax Calculation

- Klarna

- Click to Pay: Enabled in theBusiness Center

- Apple Pay: Enabled in theBusiness Center

Configuring Backend Settings

Follow these steps to access the configuration settings in the administration section

of your

Adobe Commerce

console:- Go to theAdobe Commerceadministration console.

- On the left navigation panel, clickStores.

- Under Settings, clickConfiguration.

- On the Configuration page, clickSalesto expand the menu.

- ClickPayment Methods.

- ChooseOTHER PAYMENT METHODS >.Visa Acceptance Solutions

ADDITIONAL INFORMATION

Complete all of the required fields in the sections and subsections of the settings to configure theVisa Acceptance Solutionspayment module and other payment methods. Expand each section to complete the fields.

Configuring General Settings

The settings under the General section apply to all payment methods. Follow these steps to complete this section:

- From the Cybersource setting, click the arrow to expand the General section.

- From theDebug Modedrop-down list, chooseYesto troubleshoot using theAdobe Commercelogs (cybs.log). Diagnostic information is stored in log files on theAdobe Commerceweb server.

- From theSort Orderdrop-down list, change the default module sort order.

- In theShow Exact Rejection or Error Message to Usersoption set to:

- Noto display general error messages according toAdobe Commerce Cloudin all rejection and error cases.

- Yesto display general error message according to the responses fromVisa Acceptance Solutionsin all rejection and error cases.

- In theOverride Payment Error Route Pathfield, enter the error page route path. When you leave the defaultUse system valuebox checked, the checkout or cart route is used if no path is entered.

Configuring WebService

The WebService configuration includes the default

Adobe Commerce

merchant ID (applies to all the payment methods), the REST shared key, and the

SOAP key detail. Follow these steps to complete the configuration:- ClickWebService Configurationto expand the section.

- In theMerchant IDfield, enter yourVisa Acceptance Solutionsmerchant ID.

- From theTest Modedrop-down list, choose:

- Yesto use theBusiness Centertesting environment.

- Noto use the productionBusiness Center. Optionally, in theDeveloper IDfield, you can enter the developer ID. The ID cannot exceed eight characters. You can also request thatVisa Acceptance Solutionsassign you a developer ID.

- In the Simple Order P12 Key File section, upload the SOAP p12 certificate and then enter the Key Password. If you did not generate a key, see Creating a SOAP p12 Certificate for instructions.

- In theREST API Key Detailfield, enter the REST key you generated from theBusiness Center. If you do not have a REST Shared Secret Key Pair, see Creating a Shared Secret Key Pair for instructions.

ADDITIONAL INFORMATION

Proper configuration of the SOAP WebService is required for the functioning of other services includingTax Calculation, Secure Acceptance, PayPal, Account Takeover Protection, andApple Pay. If you experience issues with these modules, verify that the SOAP WebService options are configured correctly. The SOAP p12 Certificate must have the correct password and the Test Mode option must match the correct environment for theVisa Acceptance SolutionsBusiness Center(test). - In theREST API Shared Secret Keyfield, enter the Shared Secret key you generated from theBusiness Center. If you do not have a REST Shared Secret Key Pair, see Creating a Shared Secret Key Pair for instructions.

ADDITIONAL INFORMATION

Proper configuration of the REST Web Service is required for other services including Flex Microform,, Google Pay, and the Account Updater. If you experience issues with these modules, verify that the REST Web Service options are configured properly. The API Key Detail and API Shared Secret Key must have the correct value, and theDecision Manager,Test Modeoption must match the environment for theVisa Acceptance SolutionsBusiness Center.

Configuring Device Fingerprinting

Device Fingerprinting is used with

Decision Manager

for all relevant payment

methods. If you are not using Decision Manager

, you must disable this

module. Follow these steps to configure device fingerprinting:- ClickDevice Fingerprintto expand the section.

- In theActivefield, chooseYesto activate it orNoto deactivate it if you are not usingDecision Manager.

- In theOrg IDfield, enter the value provided to you. To obtain this value either for test or production, contact yourVisa Acceptance Solutionsrepresentative.

Configuring the Delivery Address Verification Service

The Delivery Address Verification Service acts as an additional layer of address

verification and normalization on the shipping page. Follow these steps to configure

this section:

- ClickDelivery Address Verification Serviceto expand the section.

- From theAddress verificationdrop-down list, chooseYesto enable this service orNoto disable this service.

- From theAddress Force Normalizationdrop-down list, chooseYesto require the use of suggested address alternatives orNoto make suggested address alternatives optional.

Configuring Credit Card Payments

Follow these steps to configure

Visa Acceptance Solutions

credit card

payments:- From theEnableddrop-down list, chooseYesto activate orNoto deactivate the credit card payment method.

- In theTitlefield, enter the text you want to display as the name for credit card payment method. This name will be used for Web Mobile, Flex Microform, and Silent Order Post.

- In thePayment APIdrop-down list, choosePayment APIto have an authorization performed and post card data toVisa Acceptance Solutions. ChooseSOAP Toolkit APIto have the card information tokenized. The SOAP service separately requests authorizations.

- In theCheckout Flow Typedrop-down list, choose a desired checkout type.

ADDITIONAL INFORMATION

Visa Acceptance Solutionsrecommends that you chooseFlex Microform. Flex Microform is a REST-based Microform Integration to access new enhancements, easier configuration, and updated technology.You will use all of the benefits from the Hosted Checkout and Checkout API.The customer never leaves your checkout page and is a potential SAQ A qualification. For more information about Microform Integration, see Microform Integration. - In theCSRF Token Expiration Time (Seconds)field, enter the expiration time in seconds. This is the lifetime of the SOP security token used to prevent card testing attacks. For the default of 600 seconds, leave this field blank.

Configuring Strong Customer Authentication

When payer authentication is enabled and a transaction is declined with reason code

478

(Strong Customer Authentication required), another request is sent

from the Adobe Commerce

module for the same order. The customer must

complete a 3-D Secure

challenge. To configure this setting, click

Strong Customer Authentication

to

expand the section. In the Enforce Strong Customer Authentication when saving a

card

drop-down list, choose Yes

to have the cardholder

complete a 3-D Secure

challenge while saving a card.Configuring Credit Card Settings

Follow these steps to complete the Credit Card Settings section:

- ClickCredit Card Settingsto expand the section.

- From thePayment Actiondrop-down list, chooseAuthorize OnlyorAuthorize and Capture. Authorize Only reserves funds during checkout and captures when making an invoice. The Authorize and Capture payment action authorizes and captures funds during the customer checkout.

- From theAuth Indicatordrop-down list, choose the purpose of the authorization.

- From theNew Order Statusfield drop-down list, choose the order status assigned to the order when successfully paid, or leave the defaultUse system valuebox checked forProcessingorder status.

- From theIgnore AVSdrop-down list, chooseYesto have the results of AVS verification ignored.

- In theIgnore CVNfield, chooseYesto have the results of CVN verification ignored.

- In theSkip Fraud Management for Tokenizationfield, chooseNoto haveSkip Decision Managerfield set tofalsefor Secure Acceptance tokenization requests and set totrueotherwise.

- In theSkip Pre-Authorization Check for Tokenizationfield, choose toNoto have theskip preauthorizationfield set tofalsefor Secure Acceptance tokenization requests and set totrueotherwise.

- In thePass expiration date for tokenized card via SOAPfield, specify the card expiration date with SOAP Toolkit Authorization Calls for card tokenization.

- In theCredit Card Typesbox, choose which card types you want to accept. This only applies toCheckout API andFlex Microform configuration.This option is not used for Hosted Checkout.

- In thePayment from Applicable Countriesfield, leave the defaultUse system valuebox checked to accept credit card payments from the countries choose, or clear theUse system valuebox to specify countries in the next field.

- To specify the countries from which to accept credit card payments, inPayment from Specific Countriesbox choose the countries.

- From theOverride secure acceptance localedrop-down list, leave the defaultUse system valuebox checked to use the store locale language.

Configuring Payer Authentication

The Payer Authentication (

3-D Secure

) protocol reduces fraud and security to online

payments. 3-D Secure

adds frictionless authentication and improves the user

experience. You must have the SOAP Toolkit configured to use this service. Follow these steps to configure the Payer Authentication section:

- ClickPayer Authenticationto expand the section.

- From theEnableddrop-down list, chooseYesto activate the Payer Authentication Module orNoto deactivate it.

- From theCredit Card Typesfield box, choose the card types to be enabled for Payer Authentication.

Configuring Save Card for Later Service

Follow these steps to configure Save Card for Later Service settings:

- ClickSave Card for Later Serviceto expand the section.

- From theEnableddrop-down list, chooseYesto enable the customer to save their credit card information securely for later use.

- In theSaved Card Section Titlefield, enter the name of the saved cards payment method.

- From theSave Card for Later for Admin ordersdrop-down list, chooseYesto enable storing card details for orders placed in the admin area.

- From theUse CVV for Saved Credit Cardsdrop-down list, chooseYesto enable the customer to enter the Card Security Code when paying with a stored card.

- From theUse CVV for Saved Credit Cards in Admindrop-down list, chooseYesto allow the merchant to enter the customer’s Card Security Code when the customer is paying with a stored card.

- ClickSave Config.

Configuring reCAPTCHA

The

Adobe Commerce

SOAP Toolkit API provides an option to use

reCAPTCHA. This feature is essential in protecting the merchant's store from brute force

attacks. Most of the time, the reCAPTCHA is invisible to normal users, but it will

provide a visible challenge when necessary. The module providing reCAPTCHA is an

optional package.Installing reCAPTCHA

To install reCAPTCHA, run the

following command for composer installation:

composer require

Visa Acceptance Solutions

/module-recaptcha Creating reCAPTCHA

Follow these steps to

generate Google reCAPTCHA Site Key and Secret Key:

Configuring reCAPTCHA in Adobe Commerce

Adobe Commerce

- Go theAdobe Commerceconsole.

- On the Payment Methods page, under theVisa Acceptance Solutionssettings, clickreCaptchato expand the section.

- From theEnableddrop-down list, chooseYesto activate, orNoto deactivate reCAPTCHA.

- In theWebsite API Keyfield, enter your site key obtained from reCAPTCHA Admin Console.

- In theSecret API Keyfield, enter your secret key obtained from reCAPTCHA Admin Console.

- From thereCAPTCHA typedrop-down list, choose the reCAPTCHA type that you choose for your API keys.

- In theBadge positionfield, choose the reCAPTCHA badge position.

- In thereCAPTCHA languagefield, choose a language code for reCAPTCHA or leave theAutooption selected.

- ClickSave Config.

- Clear theAdobe Commercecache.

Configuring the eCheck Payment Module

eCheck

Payment ModuleThe

Visa Acceptance Solutions

eCheck

module enables customers to make purchases using a routing

number and an account number. During checkout, an eCheck

transaction

request is sent to Visa Acceptance Solutions

. If successful, the transaction is sent

to the Automated Clearing House (ACH).The

Adobe Commerce

queries Visa Acceptance Solutions

periodically

to check on the status of each pending eCheck

transaction. In

response, Visa Acceptance Solutions

provides an updated transaction status, known as a

Payment Event Type

. Various outcomes can occur during ACH processing. For

each pending transaction included in the Visa Acceptance Solutions

response, the

Adobe Commerce

determines whether a transaction remains

pending, settles, or is rejected.You can configure these

eCheck

payment event types :- Pending Event Type: No change is made to the transaction or order status. The order remains in Payment Pending state.

- Reject Event Type: The order is cancelled.

- Accept Event Type: An invoice is prepared for that order, and the order status changes to processing.

Testing eCheck Payment Settings

eCheck

Payment Settings You can test the

eCheck

Payment Event Types using two Adobe Commerce

settings that simulate possible event types during

the processing of the requested report. While the status request goes to Visa Acceptance Solutions

, the Adobe Commerce

ignores the

returned Payment Event Type in the response and uses the Test Event Type

instead.Follow these steps to test the

eCheck

Payment Event

Types:- Clickto expand the section.eCheck

- From theEnableddrop-down list, chooseYesto enable theeCheckpayment method.

- In theTitlefield, enter the text that is displayed to customers as the name of this payment method.

- Configure the payment statuses for these event types:

ADDITIONAL INFORMATION

- In theAccept Event Typebox, choose which payment statuses will mean accept, and signify the receipt of funds and move the order status to processing.

- In thePending Event Typebox, choose which payment statuses will mean pending.

- In theReject Event Typebox, choose which payment statuses will mean reject because they were rejected after processing by ACH despite being initially accepted during checkout.

- Configure how to accept theeCheckpayment method:

ADDITIONAL INFORMATION

- To accept the default country configuration, in thePayment From Applicable Countriesfield, ensure theUse system valuebox is checked.

- To specify any other countries you will accept theeCheckpayment method from, clear theUse system valuebox and in thePayment From Specific Countriesbox, choose the countries.

- To require customers to enter a drivers license number, from theEnabled Drivers License Numberdrop-down list, chooseYes. ForTeleCheck, contact a representative to see if this field is required.

- To require the customer to enter the check number, from theEnabled Check Numberdrop-down list, chooseYes. These processors have specified whether it is required or optional:

ADDITIONAL INFORMATION

- Chase Paymentech Solutions: Optional.

- Cybersource ACH Service: Not used.

- : Optional on debits, and required on credits.

- TeleCheck: Strongly recommended on debit requests, and optional on credits.

- To require an agreement at the checkout page, from theAgreement Requireddrop-down list, chooseYes.

- From theSEC codedrop-down menu, choose a code that specifies the authorization method for the transaction.

- In theSort Orderfield, enter the number of entries to be sorted on a page.

- ClickSave Config.

Configuring Fraud Management

You must configure the

Adobe Commerce

to work with Fraud Management

to use all of the features. Follow these steps to configure Fraud Management in

Adobe Commerce

:- ClickFraud Managementto expand the section.

- From theEnable Fraud Management CRON Jobdrop-down list, chooseYes.

- In theFraud Management fail email senderoption, leave theUse system valuebox checked.

- In theFraud Management fail email templateoption, leave theUse system valuebox checked.

- From theSettle Fraud Management accepted order automaticallydrop-down list, chooseYes.

- Expand theOn-Demand Jobsection to see theReport Datefield.

- Enter a date to download an accepted or rejected transactions report, and clickRun.

- ClickSave Config.

Fraud Management Orders

The

Decision Manager

rule setting and the response received for

authorizations and sales service determine whether the Adobe Commerce Cloud

marks the orders as Pending Review. On the

Decision Manager

Case Management page, when you change an order from

REVIEW

to REJECT

or

ACCEPT

, the Adobe Commerce Cloud

updates

payment transaction states periodically (by cron every two minutes) by contacting

Cybersource and querying for changes.In the settings, find the

Adobe Commerce Cloud

Cron settings and

configure them to trigger an Adobe Commerce Cloud

task. The task

looks for Decision Manager

changes in the Business Center

and

updates the Adobe Commerce Cloud

Orders accordingly.

If the module detects a change in state, it updates the order status in the

Adobe Commerce Cloud

from Pending Review to one of these states:- Processing

- Pending

- Closed

If an order is Pending Review in

Decision Manager

, you

cannot prepare an invoice in the Adobe Commerce Cloud

until

Decision Manager

accepts it.

Fraud Management Refunds

Decision Manager

must either accept or reject an order before issuing a

refund. If you reject an order in Decision Manager

, an Authorization

Reversal for the order automatically occurs as part of the Cron process that queries

for updates in Decision Manager

.Configuring Custom Fields

Decision Manager

supports custom fields known as merchant-defined data

fields. You must configure the fields inside Decision Manager

in the

Business Center

to use them. The Module for the Adobe Commerce Cloud

sends 10 of these fields. Follow these steps to add

custom fields provided by the

Adobe Commerce Cloud

:

- Log in to theBusiness Centerand go toDecision Manager> Shared Configuration > Custom Fields.

- ChooseMerchant Custom Fields.

- To add a field, clickADD CUSTOM FIELD, enter a name, and choose anorder element. Use the list below to map the correct names and elements for each field:

- Logged-in customer:Merchant_defined_data1

- Account creation date:Merchant_defined_data2

- Purchase History Count:Merchant_defined_data3

- Last Order Date:Merchant_defined_data4

- Member account age:Merchant_defined_data5

- Repeat customer:Merchant_defined_data6

- Coupon Code Used:Merchant_defined_data20

- Discount Amount:Merchant_defined_data21

- Gift Message:Merchant_defined_data22

- Order Source:Merchant_defined_data23

- Shipping Method Code:Merchant_defined_data31

- Shipping Method Description:Merchant_defined_data32

- ClickSave.For detailed instructions on how to add custom fields, see theDecision ManagerGuide. In theBusiness Center, go to the left navigation panel, and chooseDecision Manager > Documentation > Guides.

Configuring Apple Pay

To use Apple Pay, you must meet these prerequisites:

- Have a valid Apple Developer Account.

- All pages that incorporate Apple Pay must be served over HTTPS.

- Your website must comply with the Apple Pay guidelines. For more information, see Apple Pay on the Web Acceptable Use Guidelines.

- Your website must have HTTPS mode enabled and used at checkout. For more information, see Setting Up Your Server.

To configure Apple Pay with the

Adobe Commerce

module, you must

complete these tasks:- Register an Apple Pay merchant ID. For more information, see Create Your Apple Pay Merchant ID.

- Create a Payment Processing certificate in theBusiness Center. For more information, see Part 2: Create an Apple Pay Payment Processing Certificate.

- Validate your store domain in Apple Pay. For more information, see Register a Merchant Domain.

- Create a Merchant Identity certificate. For more information, see Create a Merchant Identity Certificate.

Configuring the Apple Pay Extension

Follow these steps to configure the Apple Pay extension:

- Go theAdobe Commerceconsole, and open the Payment Methods page.

- Under theVisa Acceptance Solutionssettings, clickApple Payto expand the section.

- From theEnabledrop-down list, chooseYesto activate Apple Pay. (orNoto deactivate it.)

- InTitlebox, enter the text to display to customers on the checkout page.

- From thePayment Actiondrop-down list, chooseAuthorize Onlyto reserve funds during checkout and capture during invoice creation. ChooseAuthorize and Captureto authorize and capture during customer checkout.

- From theNew Order Statusdrop-down list, choose the order status assigned to an order that was successfully paid withVisa Acceptance Solutions.

- In theApple Merchant IDbox, enter your Apple Pay Merchant ID.

- In theApple Display Namebox, enter the business name that appears on a bank or credit card statement. For example, COMPANY, INC.

- In theCertified Domainbox, enter the validated site domain on which the service is meant to be used. Do not enter ahttps://prefix.

- In thePath to Certificatebox, enter the full path to the Merchant ID Certificate file.

- In thePath to Keybox, enter the full path to the Merchant ID Certificate Private key file.

- In theCredit Card Typesbox, choose the types of credit cards to accept for payment.

- In theSort Orderbox, enter a number for the sort order.

Configuring Apple Pay

You must configure Apple Pay on your storefront that is displayed to the customer.

Follow these steps to configure Apple Pay on your storefront:

- While the customer is making a payment, in the Reviewing the order page, the customer chooses.Adobe CommerceApple Pay

- An Apple Pay window appears, requesting fingerprint (Touch ID) authentication but you can also choose a saved card.

- After authentication is complete, an order success page appears. Verify the transaction details inBusiness Center.

Configuring Google Pay

To use Google Pay on the

Adobe Commerce

, your site must be running

through HTTPS. Follow these steps to configure Google Pay in the Adobe Commerce

:- ClickGoogle Payto expand the section.

- From theEnabledrop-down list, chooseYesto activate Google Pay. (orNoto deactivate Google Pay.)

- In theTitlebox, enter text to display to customers on the checkout page.

- From thePayment Actiondrop-down list, chooseAuthorize Onlyto reserve funds during checkout and capture during invoice creation. ChooseAuthorize and Captureto authorize and capture funds during customer checkout.

- In theGoogle Pay Merchant IDbox, enter your Google Pay merchant ID.

- In theMerchant Display Namebox, define your business name that appears on a customer's bank or credit card statement. For example, “COMPANY, INC.”

- Configure which countries you will accept Google Pay from:

ADDITIONAL INFORMATION

- To accept payment from the default countries, in thePayment From Applicable Countriesfield, leave theUse system valuebox checked.

- To specify other countries, clear theUse system valuebox and in thePayment From Specific Countriesbox, choose the countries from where you want to accept Google Pay.

- In theCredit Card Typesfield box, choose which card types to accept.

- To show the Google Pay button on the product page, in theGoogle Pay button on Product Pagefield, chooseYes.

- To show the mini cart widget, in theGoogle Pay button in mini cartfield, chooseYes.

- In theSort Orderbox, enter a number to change the default module sort order.

- ClickSave Config.

Configuring Alternate Payments

The

Adobe Commerce

has four types of Alternate Payments modules: - PayPal. For more information, see Configuring PayPal.

- Klarna. For more information, see Configuring Klarna.

- Bank Transfer. For more information, see Configuring Bank Transfers.

- WeChat Pay. For more information, see Configuring WeChat Pay.

Click

Alt Payments

to expand the section.Configuring Klarna

Follow these steps to configure Klarna payments.You can use the default merchant ID

or you can manually configure a new merchant ID:

- ClickKlarnato expand the section.

- From theEnabledrop-down list, chooseYesorNoto activate or deactivate Klarna.

- FromTitlebox, enter the text to display to customers on the checkout page.

- From theUse Default Merchant IDdrop-down list, leaveYesselected to use the Merchant ID given in Web Service Configuration under General Settings. ChooseNoto enter another merchant ID and transaction key in the next two fields.

- If you choose not to use the default merchant ID, in theMerchant IDfield, enter a different merchant ID.

- In theTransaction Keyfield, enter the transaction key for the merchant ID you entered.

- From theNew Order Statusdrop-down list, choose the order status assigned to the order successfully paid withVisa Acceptance Solutions.

- Configure which countries you will accept Klarna from:

ADDITIONAL INFORMATION

- To accept payment from the default countries, in thePayment From Applicable Countriesfield, leave theUse system valuebox checked.

- To specify other countries, clear theUse system valuebox and in thePayment From Specific Countriesbox, choose the countries from where you want to accept Google Pay.

Configuring PayPal

Follow these steps to configure the PayPal Express Checkout, PayPal Credit, and

PayPal Billing Agreement:

- ClickPayPalto expand the section.

- From theEnabledrop-down list, chooseYesorNoto activate or deactivate PayPal.

- InTitlebox, enter the text to display to customers on the checkout page.

- From theNew Order Statusdrop-down list, choose the order status assigned to the order successfully paid with Cybersource.

- In theMerchant IDfield, enter yourAdobe Commerce Cloudmerchant ID.

- From thePayPal Redirection Typedrop-down list, chooseTraditional Express Checkoutto redirect the customer PayPal Payment Page, or chooseIn-Context Express Checkout for a PayPalpop-up to appear for customers to complete payment.

- From thePayment Actiondrop-down list, chooseAuthorize Onlyto check the account for validity, but not charge until the order is approved and invoiced. ChooseAuthorize and Captureto charge the PayPal account at the time the order is submitted.

- Configure which countries you will accept PayPal from:

ADDITIONAL INFORMATION

- To accept payment from the default countries, in thePayment From Applicable Countriesfield, leave theUse system valuebox checked.

- To specify other countries, clear theUse system valuebox and in thePayment From Specific Countriesbox, choose the countries from where you want to accept PayPa.

- From theEnable PayPal Creditdrop-down list, chooseYesto enable financing through PayPal Credit.

- In thePayPal Credit Titlebox, enter the text customers will see as the title of PayPal Credit payment option.

- From theEnable PayPal Billing Agreementsdrop-down list, chooseYesto allow registered customers to create a billing agreement for faster purchases.

- In theSort Orderbox, enter a numeric value to place this payment method amongst all the otherAdobe Commercepayment methods.

Configuring Bank Transfers

Online banking services enable customers to pay for goods using direct online bank

transfers from their bank account to your

Adobe Commerce

merchant

account.Click

Bank Transfer

to expand the section. In the

Store Name

field, enter the name you want customers to

see on their bank transfer invoices.Configuring iDEAL

Follow these steps to configure an iDEAL payment:

- ClickiDEALto expand the section.

- In theEnabledrop-down list, chooseYesto activate the iDEAL bank transfer (orNoto deactivate iDEAL bank transfer.)

- InTitlebox, enter the text to display to customers on the checkout page.

- In theUse Default Merchant IDfield, leaveYesselected to use the merchant ID given in the Web Service Configuration under General Settings page. ChooseNoto enter another merchant ID and transaction key in the next two fields.

- If you choose not to use the default merchant ID, enter yourVisa Acceptance SolutionsMerchant IDin theMerchant IDfield.

- In theTransaction Keyfield, enter the transaction key for the merchant ID you entered.

- In theAllowed Currenciesbox, choose which currencies you will accept payment.

- In theSort Orderbox, change the default module sort order.

- Configure which countries you will accept Klarna from:

ADDITIONAL INFORMATION

- To accept payment from the default countries, in thePayment From Applicable Countriesfield, leave theUse system valuebox checked.

- To specify other countries, clear theUse system valuebox and in thePayment From Specific Countriesbox, choose the countries from where you want to accept iDEAL.

Configuring Bancontact

Follow these steps to configure Bancontact bank transfer payments:

- ClickBancontactto expand the section.

- In theEnabledrop-down list, chooseYesorNoto activate or deactivate Bancontact Bank Transfer.

- InTitlebox, enter the text to display to customers on the checkout page.

- In theUse Default Merchant IDfield, leaveYesselected to use the Merchant ID given in Web Service Configuration under General Settings. SelectNoto enter another merchant ID and transaction key in the next two fields.

- If you choose not to use the default merchant ID, enter yourVisa Acceptance Solutionsmerchant ID in theMerchant IDfield.

- In theTransaction Keyfield, enter the transaction key for the merchant ID you entered.

- In theAllowed Currenciesbox, choose the currencies with which to accept payment.

- In theSort Orderbox, change the default module sort order.

- Configure which countries you will accept Klarna from:

ADDITIONAL INFORMATION

- To accept payment from the default countries, in thePayment From Applicable Countriesfield, leave theUse system valuebox checked.

- To specify other countries, clear theUse system valuebox and in thePayment From Specific Countriesbox, choose the countries from where you want to accept Bancontact.

Configuring WeChat Pay

WeChat Pay is a digital wallet that enable customers to make mobile payments and

online transactions. Customers who have provided bank account information can use

the app to pay bills, order goods and services, transfer money to other users, and

pay in stores if the stores have a WeChat payment option.

Follow these steps to configure WeChat Pay:

- ClickWeChat Payto expand the section.

- From theEnabledrop-down list, chooseYesto activate or deactivate WeChat Pay (orNoto deactivate WeChat Pay.)

- In theSort Orderbox, change the default module sort order.

- InTitlebox, enter the text to display to customers on the checkout page.

- In theUse Default Merchant IDfield, leaveYesselected to use the merchant ID from the Web Service Configuration section under General Settings. ChooseNoto enter another merchant ID and transaction key in the next two fields.

- If you choose not to use the default merchant ID, enter yourVisa Acceptance Solutionsmerchant ID in theMerchant IDfield.

- In theTransaction Keyfield, enter the transaction key for the merchant ID you entered.

- In theQR Code Expiration Timefield, enter an expiration time in seconds for the WeChat pay QR code.

- In theCheck Status Frequencyfield, enter an interval in seconds between transaction status checks.

- In theMax Status Requestsfield, enter a limit for transaction status checks.

- Configure which countries you will accept WeChat Pay from:

ADDITIONAL INFORMATION

- To accept payment from the default countries, in thePayment From Applicable Countriesfield, leave theUse system valuebox checked.

- To specify other countries, clear theUse system valuebox and in thePayment From Specific Countriesbox, choose the countries from where you want to accept WeChat Pay.

- In theSuccess/Failure Message Delayfield, enter a delay in seconds between the transaction check and redirection to the result page.

- In theCheck Status query Simulated Responsefield, choose a simulated status check response code for testing.

- ClickSave Config.

Configuring Taxes

Visa Acceptance Solutions

offers a service that calculates taxes to be charged on

orders. You must configure your settings in order to receive accurate resultsContact your

Visa Acceptance Solutions

representative to have this feature enabled.

This feature includes activation of sandbox capabilities as well.Before configuring the Tax Calculation service, you must have the SOAP Web Service

configured. For more information, see Configuring Security Credentials.

To use the Tax Calculation Service, you must have the Product Tax Class codes and

Visa Acceptance Solutions

Tax Services settings configured. For more

information, see Configuring Product Tax Classes and Configuring Visa Acceptance Solutions Tax Services Settings.Configuring Product Tax Classes

Each product in the

Adobe Commerce

has a setting for Tax Class.

This setting defines the product and how it should be taxed. Contact your Visa Acceptance Solutions

representative for a list of available product tax class IDs

and your tax consultant for advice on which IDs you should use for products you

sell.Follow these steps to set the product tax class IDs in

Adobe Commerce

:- Go theAdobe CommerceAdmin console.

- On the left panel, clickStores, and then clickTax Classes.

- On the Tax Classes page, clickAdd Newto create a new tax class entry for each tax class ID that your representative provides.

- In theTax Class Codefield, enter the code provided to you.

- From theTax Class Typedrop-down list, chooseProduct.

- ClickSave.

- Complete these steps for each tax class ID.

Configuring Visa Acceptance Solutions Tax Services Settings

Visa Acceptance Solutions

Tax Services SettingsFollow these steps to configure

Visa Acceptance Solutions

Tax Services in the

Adobe Commerce Cloud

:- Go to theAdobe Commerce Cloudadmin console, and in the left panel, clickStores, and then clickConfiguration.

- On the Configuration page, go toSales > Tax > Cybersource Tax Services.

- From theTax Calculationdrop-down list, chooseYesto activate theVisa Acceptance SolutionsTax Services per your business requirements.

- In theNexus regionsbox, select the regions where your business has a physical presence in the U.S. or Canada.

- In theCustomer countries to calculate Tax forbox, choose the countries for which you will calculate tax.

- In theCustomer Tax classes to exclude from Tax calculationbox, choose the customer tax classes to exclude from tax calculation.

- In theShip Fromfields, enter the city, postcode, country, and region from which the orders are shipped.

- In theAcceptancefields, enter the city, postcode, country, and region in which you will accept or approve customers' orders.

- In theOriginfields, enter the city, postcode, country, and region of the point of origin from which the order is picked up.

- In theMerchant VATfields, enter the merchant VAT seller registration number.

- ClickSave Config.

Calculating Taxes for Shipping Rates

You might have taxes calculated for shipping rates if your site offers dynamic

shipping rates from a carrier that is presented to the customer at checkout.

However, if you offer a flat-rate shipping charge, you might want to add taxes

to that flat rate.

Follow these steps to add taxes to flat shipping rates:

- On the Configuration page, go toSales > Tax > Tax Classes.

- From theTax Class for Shippingdrop-down list, select the product tax code that references the taxes applied to shipping services.

- ClickCalculation Settings.

- In theShipping Pricesfield, chooseExcluding Taxwhen the shipping rates need to be taxed. SelectIncluding Taxwhen the shipping rates already include taxes , and no taxes are applied through theVisa Acceptance Solutionstax service.

- ClickSave Config.

Configuring Transactional Emails

When an order is flagged for

Decision Manager

review, the customer is not

informed that their transaction was not fully accepted. If a manual review leads to

a rejection of the transaction, the customer is then informed that their order is no

longer active. You can configure the email sent to the customer.Follow these steps to configure the transactional emails sent to the customers:

- Go to theAdobe Commerceconsole.

- On the left panel, chooseMarketing.

- ClickEmail Templates.

- In the table, find the Template column, and click theDM Fail Transactiontemplate row. The Template Information page opens.

- On the Template Information page, complete the required information in the template name, subject, and content text boxes.

- ClickSave Template.

Configuring Cron Settings

Follow these steps to configure Cron settings for

Decision Manager

:- In theAdobe Commerceconsole.

- On the left panel, clickStores.

- Go toConfiguration > Advanced > System > Cron (Scheduled Tasks).

- Scroll down and clickCron configuration options for group:dm.

- Complete the required fields.

- ClickSave Config. For further instructions on how to configure Cron settings, see Cron (scheduled tasks).

Configuring Tokens

When a customer is logged in and is checking out, their card data can be stored in a

secured

Visa Acceptance Solutions

data center. After the card data is saved, a token

is provided to you through this module. This token represents the customer record. When

a returning customer uses your checkout, they can opt to use a previously stored card so

they don't have to enter their card data again.When a token is used, the customer is still redirected to the

Visa Acceptance Solutions

Hosted Payment page for payment confirmation. If a customer chooses to checkout as a

guest, the token system is not used.Saving a Card for Later Use

To save the card, log in or register a new customer account. During the checkout

process, check the

Save for later use

box. After the order is

placed, the card information is securely saved with Visa Acceptance Solutions

.Managing the Adobe Commerce Tokens

Adobe Commerce

TokensCustomers who are logged in can delete their tokens at any time. To do so, they must

visit the My Account section of the

Adobe Commerce

and choose

the Stored Payment Methods

menu item. Customers can use the

delete links beside any stored tokens to remove a stored token.Paying with Tokens

To pay the order with a stored card, the customer chooses it from the list at the top

of the Billing and review checkout page.

Multi-Shipping Feature

The plugin supports the multi-shipping feature only for the

Adobe Commerce

registered users when they place orders with stored credit

cards.Node Implementation

The plugin does not support multiple-node implementation.

Support

If you require support with this software, create a support ticket at support and

provide this information:

- Summary of the issue

- Steps to reproduce the issue

- Magento platform versionVisa Acceptance Solutionsplug-in version

- Visa Acceptance Solutions merchant ID

- Configuration screenshots

- All the themes/additional extensions that are installed

- Log files

To retrieve log files, navigate to this path in the root directory of Magneto:

Magento Folder Name\var\log

.These log files are needed:

- system.log

- debug.log

- cybs.log

- exception.log

OpenCart

The plugin for OpenCart provides a payment solution for

merchants using OpenCart to manage their orders. This section describes the payment

methods and services the Plugin provides.

Supported payment methods

These are the supported payment methods for OpenCart:

- Credit and debit cards

- eCheck

- Click to Pay

Supported payment services

These are the supported payment services available for OpenCart:

- Payment acceptance services

- Authorization only

- Sale (bundled authorization and capture)

- Electronic check debit (sale) foreCheckpayment method

- Order management services

- Capture an authorization(not foreCheck)

- Multiple partial captures (not foreCheck)

- Standard and partial refunds

- Standard and partial void captures(not foreCheck)

- Standard and partial void refunds

- Full authorization reversal(not foreCheck)

- :Token Management Service(TMS) for credit and debit cards payments

- Create payment token along with authorization

- Update an existing token along with authorization

- Update an existing token from My Account section

- Delete an existing token from My Account section

- Create payment token for new payment methods during checkout

- Make a payment with a stored token during checkout

- Reporting services that allow you to import theses:Business Centerreports into OpenCart

- Transaction Request Report

- Payment Batch Detail Report

- Conversion Detail Report

Release Information

This section provides information about the releases for the plugin.

Release Version | Release Date | Support End Date |

|---|---|---|

Version 22.1.0 | October 25, 2022 | October 14, 2025 |

Version 23.1.0 | December 8, 2023 | December 7, 2026 |

Version 23.1.0 includes the following enhancements:

- Updated authentication signature

- Added DAV enable/disable button for admin configuration

- Updated reCAPTCHA key generation tooltip URL

- Fix for target origin issue for different domain in the flex form capture context

- Compatible with OpenCart versions 3.0.3.7 and 3.0.3.8

Version 22.1.0

- Initial release.

Installation

Before you install the plugin, make sure that these requirements are met:

- You are usingOpenCartversion 23.1.0.

- You have aBusiness Centeraccount and have generatedBusiness CenterREST API keys:

- To create an account, go to the website.

- To generate REST API keys, see .

Follow these steps to install the plugin:

- Download the plugin from theOpenCartwebsite to your local system.

- OpenOpenCartBack Office and from the Dashboard, chooseExtensions>Installer.

- ClickUploadand browse to the file you downloaded to your local system.The pane displays the status of the installation. After the Plugin is installed, the pane indicates that the module is installed. You can close it or clickConfigureto configure the Plugin.

Configuration Overview

This section describes how to set up the plugin.

The following table shows where to access the plugin configuration settings.

From the left navigation panel in

OpenCart

Back Office, select

Extensions

and follow the path indicated in the table for the configuration

settings you want to configure. Settings | Path |

|---|---|

| Extensions > Extensions > Modules > Visa Acceptance Solutions

Configuration |

Unified Checkout

| Extensions > Extensions > Payments > Visa Acceptance Solutions

Unified Checkout |

eCheck

| Extensions > Extensions > Payments > Visa Acceptance Solutions

eCheck |

Enable Basic Configuration

This section describes the required and optional basic configuration settings for the

plugin.

To enable Basic Configuration, follow these steps:

- InOpenCartBack office, navigate toExtensions>Extensions>Modules>.Visa Acceptance SolutionsConfiguration

- Click theEditicon.

- In the General Configuration tab of the EditVisa Acceptance SolutionsConfiguration Module pane, from the drop down list or text box, select or enter a setting.

- Click theSaveicon.

- Repeat for each required setting and each optional setting you want to enable.

Required Settings

These settings are required for using the plugin:

- Sandbox Mode

- Set toEnableto operate in Sandbox (T) mode. You can test new changes in this mode and no funds are affected.

- Set toDisableto operate in Production (Live) mode.

- Merchant ID

- Enter theBusiness CenterMerchant ID or Organization ID, which is a unique identifier for the merchant.

- Merchant Key ID

- Enter your REST Shared Secret Key generated from within theBusiness Center. This specific key authenticates and authorizes the merchant's integration with the gateway.

- Merchant Secret Key

- Enter the complimentary Secret key that is generated at the same time as the Merchant Key ID. It is used for secure communication between the merchant's online store and a payment gateway.

- reCAPTCHA Site key

- For each request, this key returns a score based on the user interactions with your site. Based on these scores, you can take appropriate actions for your site, such as allowing or blocking users.

- reCAPTCHA Secret key

- This key authorizes communication between the plugin's backend and the reCAPTCHA server to verify the user's response. The secret key should be kept safe for security purposes.

Optional Settings

These settings are optional for using the plugin.

- Fraud Management

- ClickEnableto enable merchants to identify and prevent fraudulent activities.

- Delivery Address Verification

- ClickEnableto enable merchants to verify the delivery address.

- Device Fingerprint

- ClickEnableto enable merchants to identify and track devices accessing an online store.

- Developer ID

- Identifier for the developer that helps integrate a partner solution withVisa Acceptance Solutions. This settings is only required forVisa Acceptance SolutionsSystem Integrators.

- Status

- ClickEnablefor theVisa Acceptance Solutionsintegration to be active and visible at checkout.

- Payment Action

- ClickEnableto enable card payments for Authorize Only or Sale (Authorization and Capture) for front office transactions.

- Enhanced Logs

- ClickEnableto generate logs that can be accessed by selectingConfigure>Advanced Parameters>Logs.

Visa Acceptance Solutions

strongly recommends that you map your Order Status

responses to your preferred order status under the Order Status Configuration

section. Enable Unified Checkout

Unified Checkout

This section describes the required and optional configuration settings for

Unified Checkout

for the plugin. To enable Card Payment follow these steps:

- InOpenCartBack office, navigate toExtensions > Extensions > Payments >.Visa Acceptance SolutionsUnified Checkout

- Click theEditicon.

- In the EditVisa Acceptance SolutionsUnified Checkoutpane, from the drop down list or text box, select or enter the setting you want.

- Click theSaveicon.

- Repeat for each required setting and each optional setting you want to set.

Required Settings

The following settings are required:

Unified Checkout

for the plugin:- Payment Option Label

- Enter the text you want displayed to the customer at checkout.

- Allow Card Types

- Select the card types that you want to accept.

Optional Settings

The following settings are optional for enabling

Unified Checkout

for

the plugin:- Status

- ClickEnablefor theVisa Acceptance Solutionsintegration to be active and visible at checkout.

- Sort Order

- Specify an order in which a payment method displays at checkout.

Enable Tokenization