On This Page

Apple Pay Developer Guide

This section describes how to use this guide and where to find further information.

- Audience and Purpose

- This guide is for merchants who want to offer Apple Pay in an iOS mobile app or web page and use information from Apple to process payments throughVisa Acceptance Solutions. The guide describes how to integrate Apple Pay with your system and how to process and search for Apple Pay transactions. Processing is described for Apple Pay payment authorizations, sale (authorization with capture) transactions, authorization reversals, and payment captures. The method you use to extract and decrypt Apple Pay payment data depends on how you integrated Apple Pay into your iOS app or website.

- Conventions

- These statements appear in this document:IMPORTANTAnImportantstatement contains information essential to successfully completing a task or learning a concept.TIPATipcontains information that can help you to complete a tasks or learn a concept.

- Related Documentation

- When you perform tasks at the Apple Developer portal, always refer to official Apple documentation for the most up-to-date information:

- Apple ID:

- Apple Support:

- Apple Developer Support:

- Apple Developer Programs:

- Apple Developer Help:

- Apple Developer Documentation:

Recent Revisions to This Document

25.04.01

- Initial Release

Introduction to Apple Pay

Apple Pay is a digital payment solution that enables your customers

to make secure and convenient purchases without requiring them

to enter their card details or shipping information.

You can use the

Visa Acceptance Solutions

platform to process and manage Apple Pay transactions.When you offer your customers

device apps

enabled for Apple Pay, you can

collect payments for purchases made on iPhone and Apple Watch apps.

When you offer your customers Apple Pay on the web

, Apple Pay cardholders can

purchase goods and services from within your web app.

You can try an Apple Pay test transaction on the Apple Developer site

by using the Apple Pay on the Web Interactive Demo

:Using Apple Pay on the

platform can reduce the exposure of sensitive payment data to your system.

When a cardholder initiates a purchase from within your Apple Pay enabled app or web page,

Apple Pay receives the encrypted transaction.

An Apple Pay server returns the transaction payment information

re-encrypted with a developer-specific key.

The key helps to ensure that only the app or the web page

can access the encrypted information.

Visa Acceptance Solutions

Customers experience reduced payment friction because their information

is tokenized and stored for future use.

Customers who configure auto-fill options for their Apple Pay accounts

can have payment and card data pre-populate

after they sign in to their accounts and authenticate.

Two Apple Pay Decryption Methods

Integration hooks for two Apple Pay decryption methods are built into the

payment management platform.

The two decryption methods— decryption and merchant

decryption—handle Apple Pay encrypted payment data differently. You will

integrate the decryption method that best suits your technical development

environment in terms of desired degree of exposure to, or control over, sensitive

payment information.

Visa Acceptance Solutions

Visa Acceptance Solutions

IMPORTANT

The Apple Pay decryption method that you integrate

determines how you will format your API request messages when you

authorize a payment or process a sale.

To integrate Apple Pay into your system,

you simply register with both Apple and

,

generate keys and certificates (or

creates and manages them on your behalf), and

place the Apple Pay mark on your app or web page.

This guide includes instructions for integrating Apple Pay on

into your system.

The instructions cover both of the Apple Pay decryption methods.

Visa Acceptance Solutions

Visa Acceptance Solutions

Visa Acceptance Solutions

Integration Options

Visa Acceptance Solutions

supports Apple Pay in multiple integration options. Three of

the most widely used options are Visa Acceptance Solutions

Checkout API

. Each option presents specific tradeoffs

and advantages, and you can select the integration model that best fits your

business.Apple Pay integration is built into the

Visa Acceptance Solutions

payment management

platform. Visa Acceptance Solutions

offers two integration methods for handling the

payment data returned by the Apple Pay service for processing payments. In response to

an authorization request, Apple Pay returns payment data in an encrypted payload. The

encrypted payment data is handled and processed differently, depending on which

integration method is used. Both decryption methods support Apple Pay in-app and Apple

Pay on the web.Visa Acceptance Solutions

Decryption

Visa Acceptance Solutions

For

decryption,

you implement Apple Pay directly on your checkout page.

You send

creates and manages the Apple Pay decryption keys,

extracts and decrypts payment information, and

maps the information to the appropriate fields for authorization and other payment services

on your behalf.

Having

process your Apple Pay transactions

reduces your exposure to sensitive payment information.

Visa Acceptance Solutions

Visa Acceptance Solutions

all encrypted payment information that

you receive from Apple Pay.

Visa Acceptance Solutions

Visa Acceptance Solutions

Merchant Decryption

For merchant decryption, you (the merchant or the integrator)

manage all aspects of the Apple Pay implementation,

from generation of the payment encryption keys to

decryption of the payment response payload from Apple Pay.

As a merchant, you submit the Apple Pay payment token and

other payment information to

for processing.

With merchant decryption,

payment instrument details remain visible to you, and

you control the technical development that decrypts this information.

Visa Acceptance Solutions

Unified Checkout Integration

Unified Checkout Integration

Unified Checkout Integration

is a consolidated digital acceptance product.

Unified Checkout Integration

offers a single implementation for multiple payment options.

This integration type is designed for merchants looking for a single solution

for integrating multiple digital payment options.IMPORTANT

Unified Checkout Integration

is not covered in this guide. It is

mentioned here for the sake of completeness. For information about Unified Checkout, see

the .Cards Supported for Apple Pay on Visa Platform Connect

Visa Platform Connect

Visa Acceptance Solutions

supports Apple Pay on the Visa Platform Connect

payment gateway only.These payment cards are supported:

- Australia and New Zealand Banking Group Limited (ANZ)

- CitiBank Singapore Ltd.

- Global Payments Asia Pacific

- Vantiv

- Westpac

IMPORTANT

Payment processors connect with acquirers.

Before you can accept payments, you must register with a payment processor.

An acquirer might require you to use a payment processor with an existing

relationship with the acquirer.

For an overview of financial institutions and payment networks that

work together to enable payment services, see the

.

Payment Services Supported for Apple Pay

Apple Pay is supported for the

authorization, sale, authorization reversal, and capture services.

The credit and void services are also supported for Apple Pay.

Authorization

An authorization confirms that a payment card account holds sufficient funds to pay for a purchase.

A successful authorization places a hold on the funds in the account,

reducing the cardholder's available limits by the authorized amount.

The authorization service is supported with both types of Apple Pay decryption.

For more information, see these topics:

Sale (Authorization and Capture)

A sale bundles an authorization and capture into a single transaction. Request

the authorization and capture at the same time. Upon a successful transaction,

funds are immediately transferred from the cardholder account to the merchant

account. The authorization and capture amounts must be the same. The sale

service is supported with both types of Apple Pay decryption. For more

information, see these topics:

Authorization Reversal

Initiate an authorization reversal to reverse an unnecessary or undesired authorization.

A successful authorization reversal releases the hold

that the authorization placed on the cardholder’s credit card funds.

Include in the request message the request ID returned from the previous authorization

because the request ID links the reversal to the authorization.

For more information, see Reverse an Apple Pay Payment Authorization.

Capture

A capture, also known as settlement, transfers funds from the cardholder’s account to your bank,

typically in 2 to 4 days, and

it releases the hold that the authorization placed on the cardholder’s credit card funds.

Include in the capture request message the request ID returned from the previous authorization

because the request ID links the capture to the authorization.

For more information, see Capture an Apple Pay Authorization.

Credit

A is a payment

refund from your bank to the cardholder for a payment that has already been captured.

To initiate a

refund

(also known as a follow-on credit)refund

,

send a request message to the credit service

and include

the request ID that was returned in the response to the capture request.

Because the request ID links to the cardholder’s billing and account

information, you are not required to include those fields in the credit request.

Unless otherwise specified, you must request a

refund

within 180 days of a settlement.For more information about credit requests and credit authorization results,

see the "Standard Payments Processing" section of the .

Void

You can void an Apple Pay capture or credit that was submitted but is not yet processed by the processor.

You send a request for a capture void and a credit void to different endpoints.

A void is linked to a capture or credit transaction

through the request ID of the transaction you want to void.

As a best practice, also include an order reference number or a tracking number.

This number can help you to perform meaningful searches for the transaction.

For more information about void requests and responses,

see the "Standard Payments Processing" section of the .

Summary of Requirements for Using Apple Pay

This topic lists the key requirements for using Apple Pay.

More detailed information is provided in

Getting Started with Apple Pay.

- Amerchant account.Visa Acceptance Solutions

- If you do not have a merchant account, contact yoursales representative.Visa Acceptance Solutions

- Apple Pay enabled for youraccount.Visa Acceptance Solutions

- If Apple Pay is not enabled, contact yourrepresentative.Visa Acceptance Solutions

- AVisa Acceptance Solutionsevaluation account.

- To create a test account, visit theBusiness CenterSandbox Account Sign-Up page.

- Test account login page:

- AVisa Acceptance SolutionsBusiness Centerproduction account with a supported processor.

- If you do not have a production account, contact yourVisa Acceptance Solutionssales representative.

- Production account login page:

IMPORTANT

Apple Pay relies on authorizations with payment network tokens.

Your environment must meet these requirements in order to support payment network tokenization:

- Your processor supports payment network tokens.

- supports payment network tokens with your processor.Visa Acceptance Solutions

- Obtain a new merchant account with a processor that supports payment network tokens.

- Wait until your processor supports payment network tokens.

Getting Started with Apple Pay

This section describes requirements for integrating Apple Pay into your system:

- Requirements for payment network token support

- Requirements for enrolling in the Apple Developer Program

- Requirements for end-to-end testing

Requirements for Payment Network Token Support

Apple Pay relies on authorizations being processed with

test accounts and production accounts meet these requirements.

payment network tokens

. Make sure your processor and your Visa Acceptance Solutions

- Your processor supports payment network tokens andsupports payment network tokens with your processor.Visa Acceptance Solutions

- If your processor does not support payment network tokens, or ifdoes not support payment network tokens with your processor, you must obtain a newVisa Acceptance Solutionsmerchant account with a processor that supports payment network tokens.Visa Acceptance Solutions

- Yourtest account supports payment network tokens withVisa Acceptance Solutions.Visa Platform Connect

- In order to configure and validate a test integration of Apple Pay, yourmerchant test account supports payment network tokens with your processor.Visa Acceptance Solutions

- If you do not have a merchant test account that meets this criteria, contact yoursales representative.Visa Acceptance Solutions

- Yourproduction account supports payment network tokens withVisa Acceptance Solutions.Visa Platform Connect

- In order to use your Apple Pay implementation in a production environment, yourmerchant production account supports network tokens with your processor.Visa Acceptance Solutions

- If you do not have a production account that meets these criteria, contact yoursales representative.Visa Acceptance Solutions

Requirements for Enrolling in the Apple Developer Program

The Apple Pay integration process requires you to

enroll your organization in the Apple Developer Program.

The exact requirements can vary

depending on the specifics of your app and business.

Always refer to official Apple documentation

for the most up-to-date information

.

IMPORTANT

If you are enabling Apple Pay digital payments

on

Unified Checkout Integration

, see the . The requirements described in this topic apply only if you are integrating

standalone Apple Pay

for Visa Acceptance Solutions

decryption or

merchant decryption.- Your Apple device runs the latest Apple Developer app.

- The machine that you use forenrollmentmust be an Apple device that run the latest version of the Apple Developer app. You can download the app from the Apple App Store.

- You have an Apple ID with two-factor authentication and a valid payment method.

- An Apple ID grants access to Apple Developer resources, including documentation, sample code, forums, and technical support. This Apple ID can be different from the Apple ID that you used to sign in to your enrollment device.

- Two-factor authentication is required in order to sign in to your Apple Developer account and manage your account in theCertificates, Identifiers & Profilespage. The payment method associated with your Apple ID is used to pay the annual subscription fee.

- You will be the Account Holder or Admin for your organization.

- As the person enrolling your organization in the Apple Developer Program, you automatically become the Account Holder for your project. Either of these roles enables you to generate an Apple Pay encryption key to encrypt payment data during the payment flow.

- Each developer in your organization must be assigned to your project as an Account Holder or an Admin. Only an Account Holder or an Admin can create developer accounts for their team.

- You have the information about your organizations that is required for enrollment.

- You must provide basic business details and a D-U-N-S Number. Apple verifies that the information you provide is accurate and current before approving your enrollment.

- You have the authorization to pay the annual membership fee.

- The annual membership fee that you pay to Apple enables you to distribute your apps on the Apple App Store and to access beta software, beta testing tools, advanced app capabilities, and app analytics.

- You must accept the terms of the license agreement.

- You must agree to the Apple Developer Program License Agreement.

Requirements for End-to-End Testing

This topic lists the requirements for supporting end-to-end testing of Apple Pay

transaction processing in a testing environment. End-to-end testing requires that test

payment cards have been loaded to your Apple Developer sandbox tester account wallet.

IMPORTANT

If these requirements are not met, Apple Pay servers will not

return a valid payload in your test environment.

- You have an Apple sandbox tester account.

- For sandbox setup instructions, see theSandbox Testingpage in the Apple Developer portal:

- Follow the steps described in the sectionCreate a Sandbox Tester Account.

- If you are integrating the merchant decryption model, you have an Apple test device.

- You must register the device with Apple using your Apple Developer account. You will use test device to create the certificate signing request (CSR) that you will use to associate your Apple sandbox tester account with your test environment.

- If you are integrating the merchant decryption model, you will use the Apple device in one of the tasks described in Part 2: Create an Apple Pay Payment Processing Certificate.

- You have a test environment that you can access by logging in to your Apple sandbox tester account.

- To create this access, you will use the sandbox tester account to create an Apple test merchant ID. You will use the test ID to create a CSR and use the CSR to create an Apple Pay payment processing certificate. Apple Pay servers use this certificate to encrypt payment data using a key known to your test environment.

- The steps for associating a sandbox tester account with your test environment (as well as for associating an Apple production account with your production environment) are included in Part 2: Create an Apple Pay Payment Processing Certificate.

- You have test payment cards in the wallet of your Apple sandbox tester account.

- You will be instructed to add test cards to your sandbox tester account in Validating Your Test Integration.

Integrating Apple Pay into Your System

This section describes how to integrate Apple Pay into your iOS app or website. The

integration tasks are organized into three parts. The second part provides separate steps for

the two different decryption models. The third part applies only if you will be supporting

Apple Pay on the web.

You will perform the integration tasks twice: First in your test environment and, after you

validate your test integration, a second time in your production environment.

- Part 1: Set Up Your Apple Developer Account. You will enroll your organization in the Apple Developer Program, create anApple merchant ID, and register it in your developer account.

- Part 2: Create an Apple Pay Payment Processing Certificate. This certificate is associated with your merchant ID, and it is used by Apple Pay servers to encrypt payment data.

- You will generate acertificate signing request(CSR) at the system that will handle Apple Pay payload decryption. Fordecryption, you will generate the CSR at theVisa Acceptance SolutionsVisa Acceptance SolutionsBusiness Centeruser interface. For merchant decryption, you will generate the CSR at your Apple device.

- You will upload the CSR with the public key to your Apple Developer account and use the CSR to create apayments processing certificatefor your merchant ID and Apple Pay.

- Part 3: Perform Additional Setup for Apple Pay on the Web. If you offer your customers Apple Pay on the web, you will create anApple Pay merchant identity certificate, associate the certificate with your merchant ID, and registereach merchant domainthat will process Apple Pay transactions.

TIP

If you are integrating

Apple Pay with

decryption

and

you are experienced in creating Apple Pay payment processing certificates,

you can use the

Quick Integration for the Visa Acceptance Solutions Decryption Method

instead of the detailed steps in this section.Visa Acceptance Solutions

Part 1: Set Up Your Apple Developer Account

Complete the tasks in this section to

enroll your organization in the Apple Developer program and

register a new Apple merchant ID.

Starting Enrollment in the Apple Developer Program

Enrolling in the Apple Developer program as an organization

enables you to associate multiple developer accounts with your Apple Developer account.

Multiple developer accounts can be beneficial

if you have a large project with a team of developers.

For the first phase of the enrollment process,

you log in to your Apple Developer account

and submit information about your organization to Apple.

IMPORTANT

When you perform tasks at the Apple Developer portal,

always refer to official Apple documentation

for the most up-to-date information

.- Follow these steps to start the enrollment process:

- Launch the Apple Developer app on your device.

- ClickAccount, and sign in with your Apple ID.

- If prompted, review the Apple Developer Agreement and clickAgree.

- ClickEnroll Now, review the program benefits and requirements, and then clickContinue.

- At the prompts, enter your information as the Account Holder.

- At the prompts, enter information about your organization.

RESULT

After Apple verifies your information and approves your enrollment,

it sends you an email that describes the next steps.

Completing Enrollment in the Apple Developer Program

When you receive your approval email from Apple,

you will log in to your Apple Developer account again

and complete the enrollment process.

IMPORTANT

When you perform tasks at the Apple Developer portal,

always refer to official Apple documentation

for the most up-to-date information

.- Follow these steps to complete the enrollment process:

- Launch the Apple Developer app on the device you used to start the enrollment process.

- ClickAccountand sign in with the Apple ID you used to start the enrollment process.

- ClickContinue Your Enrollment, review the terms of the Apple Developer Program License Agreement, and then clickAgree.

- Review the annual membership subscription details and clickSubscribe.

Registering a New Merchant ID in Your Apple Developer Account

Finish setting up your Apple Developer account

by creating and registering a merchant ID for each environment.

A registered merchant ID uniquely identifies you to

Apple Pay as a valid entity that can accept payments.

In order to support multiple environments, such as sandbox and production,

you can create multiple merchant IDs in your Apple Developer account.

IMPORTANT

When you perform tasks at the Apple Developer portal,

always refer to official Apple documentation

for the most up-to-date information

.- Follow these steps to create a merchant ID and to register it in your Apple Developer account:

- Log in to your Apple Developer account.

- In the left navigation panel, selectCertificates, Identifiers & Profiles.

- ClickIdentifiers.

- Click the plus sign (+) on the top left.

- SelectMerchant IDsand clickContinue.

- Enter a merchant description and identifier name.

- ClickContinue.

- Verify that you entered the merchant information correctly.

- ClickRegister.

Part 2: Create an Apple Pay Payment Processing Certificate

Complete the tasks in this section to create an Apple Pay payment processing

certificate. Apple Pay servers use this certificate to encrypt payment data.

Creation of an Apple Pay payment processing certificate consists of two tasks:

- Generating a certificate signing request (CSR).

- Using the CSR to create an Apple Pay payment processing certificate.

IMPORTANT

When you generate a CSR, the sequence of steps you will

perform depends on whether you are integrating decryption and merchant decryption.

Visa Acceptance Solutions

- If you are integratingdecryption, you will generate a CSR at theVisa Acceptance SolutionsVisa Acceptance SolutionsBusiness Center. See Generating a CSR for Visa Acceptance Solutions Decryption.

- If you are integrating merchant decryption, you will generate a CSR at your Apple device. See Generating a CSR for Merchant Decryption.

Generating a CSR for Visa Acceptance Solutions Decryption

Visa Acceptance Solutions

IMPORTANT

These steps apply to setting up

decryption only. If you are integrating the merchant

decryption model of Apple Pay into your system, follow the steps in Generating a CSR for Merchant Decryption instead.

Visa Acceptance Solutions

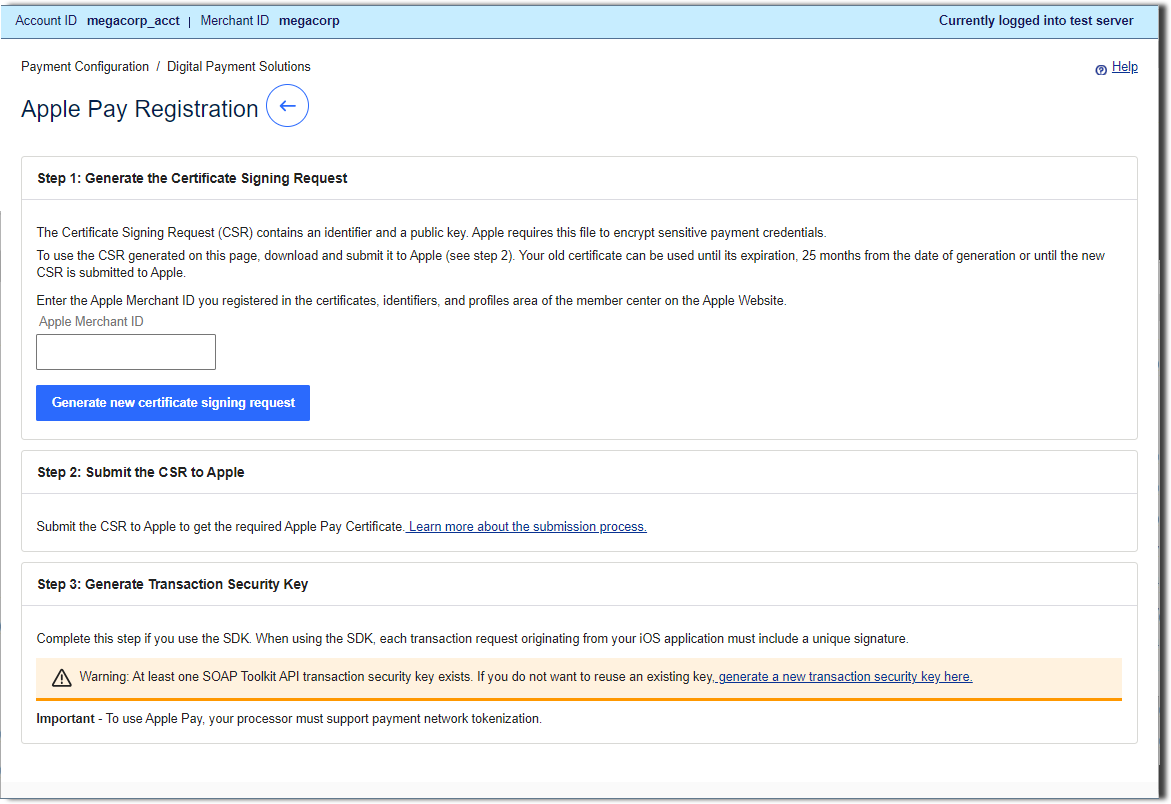

For decryption, you will use your account in the

Visa Acceptance Solutions

Visa Acceptance Solutions

Business Center

to generate a

certificate signing request (CSR). You will use the Apple Pay Registration page

within the Business Center

.If you do not have an Admin account or an account with write access, contact your

Account Admin,

Visa Acceptance Solutions

sales engineer, alliance partner, or

technical account manager.- Follow these steps at theVisa Acceptance SolutionsBusiness Centerto generate a CSR:

- Log in to yourmerchant account in theVisa Acceptance SolutionsBusiness Center.

ADDITIONAL INFORMATION

Production:ADDITIONAL INFORMATION

- In the left navigation panel, selectPayment Configuration.

- ChooseDigital Payment Solutions.

ADDITIONAL INFORMATION

The Digital Payment Solutions page appears. - ClickConfigurefor Apple Pay.

ADDITIONAL INFORMATION

The Apple Pay Registration page appears.ADDITIONAL INFORMATION

This image shows the Apple Pay Registration page in theVisa Acceptance SolutionsBusiness Center.Figure:

Apple Pay Registration Page in theVisa Acceptance SolutionsBusiness CenterInterface

- Enter the Apple merchant ID that you created and registered in your Apple Developer account.

ADDITIONAL INFORMATION

These steps are described in Registering a New Merchant ID in Your Apple Developer Account. This value should match the id you set up with Apple including the "merchant" prefix. - ClickGenerate new certificate signing request.

- Click the download icon next to the key.

- Download the certificate request file (a file with a.certSigningRequestfile extension) to your local machine.

- Use your browser controls to save the file to your local machine.

ADDITIONAL INFORMATION

In the next task, you will upload the CSR file to your Apple Developer account.

Generating a CSR for Merchant Decryption

IMPORTANT

These steps apply to setting up merchant decryption only.

If you are integrating the

decryption model of Apple Pay into your system, follow the steps in

Generating a CSR for Visa Acceptance Solutions Decryption

instead.

Visa Acceptance Solutions

For merchant decryption,

you will use your Apple device to generate a certificate signing request (CSR).

IMPORTANT

When you perform tasks at the Apple Developer portal,

always refer to official Apple documentation

for the most up-to-date information

.- Follow these steps at your Apple device to generate a CSR:

- Sign in to your Apple Developer account as the Account Holder or as an Admin and selectCertificates, Identifiers & Profiles.

- ClickIdentifiersin the sidebar.

- SelectMerchant IDsand clickContinue.

- Under Identifiers, selectMerchant IDsusing the filter on the top right.

- On the right, select your merchant identifier.

- Under Apple Pay Payment Processing Certificate, clickCreate Certificate.

Creating a Payment Processing Certificate for Your Merchant ID

Using the certificate signing request that you just created,

you will create an Apple payment processing certificate

and associate the certificate with your Apple merchant ID that you created before that.

Those earlier tasks are described in these topics:

Apple Pay uses the payment processing certificate to encrypt the customer's payment information.

This certificate expires every 25 months.

If the certificate expires or is revoked, you can recreate it.

IMPORTANT

When you perform tasks at the Apple Developer portal,

always refer to official Apple documentation

for the most up-to-date information

.- Follow these steps to create a payment processing certificate for your Apple Pay merchant ID:

- Sign in to your Apple Developer account as the Account Holder or as an Admin and selectCertificates, Identifiers & Profiles.

- Upload the CSR file and associate the CSR with your merchant ID.

ADDITIONAL INFORMATION

The CSR contains your Apple merchant ID and a public key that Apple Pay uses to encrypt sensitive payment data.- ClickIdentifiersin the sidebar.

- SelectMerchant IDsusing the filter on the top right.

- On the right, select your merchant ID.

Step Result

If a banner at the top of the page prompts you, you need to accept an agreement. ClickReview Agreementand follow the instructions that appear. - Under Apple Pay Payment Processing Certificate, clickCreate Certificate.

- Create a payment processing certificate and download the certificate to your local machine.

- ClickChoose Fileand select the CSR file that you uploaded.

ADDITIONAL INFORMATION

The CSR file has the filename extension.certSigningRequest. - ClickChoose.

- ClickContinue.

- ClickDownload.

Step Result

The payment processing certificate (a file with the filename extension.cert) appears in your Downloads folder.

- Go to the next task.

- If you offer your customers Apple Pay in a web page, go to Part 3: Perform Additional Setup for Apple Pay on the Web.

- Otherwise, proceed to Validating Your Test Integration.

Part 3: Perform Additional Setup for Apple Pay on the Web

If you develop web pages that support Apple Pay on the Web, your customers can use Apple

Pay to purchase goods and services from within your web page. You can use the same Apple

Pay merchant ID and Apple Pay payment processing certificate as required for Apple Pay

in-app implementations. However, Apple Pay on the Web requires additional set-up tasks

that you perform in your Apple Developer account:

- Creating an Apple Pay merchant identity certificate

- Registering your merchant domains with Apple

If you created multiple merchant ID and payment processing certificate pairs

to support multiple environments, such as sandbox and production,

you must associate each ID-and-certificate pair with a unique merchant identify certificate.

Creating an Apple Pay Merchant Identity Certificate

If you offer your customers Apple Pay in a web page,

you must create an Apple Pay merchant identity certificate and

associate it with your merchant ID.

You need this Transport Layer Security (TLS) certificate

in order to authenticate your sessions with the Apple Pay servers.

IMPORTANT

When you perform tasks at the Apple Developer portal,

always refer to official Apple documentation

for the most up-to-date information

.- Follow these steps to create an Apple Pay merchant identity certificate:

- Log in to your Apple Developer merchant account as an Account Holder or Admin.

- In the left navigation panel, selectCertificates, Identifiers & Profiles.

- Perform these steps for each merchant identity certificate you need to create:

- ClickIdentifiers, and click the plus sign (+) on the top left.

- SelectMerchant IDsand clickContinue.

- Enter the merchant description and identifier name, and then clickContinue.

- ClickRegister.

Registering Your Merchant Domains with Apple

Each merchant domain in your organization that will process Apple Pay transactions

must be registered with Apple.

IMPORTANT

When you perform tasks at the Apple Developer portal,

always refer to official Apple documentation

for the most up-to-date information

.- Follow these steps to register your merchant domains with Apple:

- Log in to your Apple Developer merchant account as an Account Holder or Admin.

- In the left navigation panel, selectCertificates, Identifiers & Profiles.

- Perform these steps for each merchant domain that you registered with Apple:

- ClickIdentifiers, and selectMerchant IDsin the pop-up menu on the top right.

- On the right, select your merchant identifier.

- Under Merchant Domains, clickAdd Domain. Enter the fully qualified name of the domain and clickSave.

- ClickDownload, place the downloaded file in the specified locations, and clickVerify.

- After you add all merchant domains that will process Apple Pay transactions, clickDone.

Verifying the Merchant Domains That You Registered with Apple

- Follow these steps to verify the merchant domains you registered with Apple:

- Log in to your Apple Developer merchant account as an Account Holder or Admin.

- In the left navigation panel, selectCertificates, Identifiers & Profiles.

- Perform these steps for each merchant domain that you registered with Apple:

- ClickIdentifiers, and selectMerchant IDsin the pop-up menu on the top right.

- On the right, select your merchant identifier.

- Under Merchant Domains, clickVerifynext to the domain name.

- Follow the instructions that appear on the screen.

RESULT

You can now proceed to Validating Your Test Integration.

Validating Your Test Integration

Before you integrate Apple Pay into your production environment,

validate your test integration of Apple Pay.

- Follow these steps to validate the integration in your test environment:

- Make sure your system is prepared for end-to-end testing.

ADDITIONAL INFORMATION

- Add test payment cards to the wallet of your Apple sandbox tester account.

ADDITIONAL INFORMATION

Instructions are provided in theSandbox Testingpage on the Apple Developer portal:- Follow the steps in theCreate a Sandbox Tester Accountsection.

ADDITIONAL INFORMATION

Make sure the user account has permissions to use Apple Pay. You will use this account to log in to devices and services. - Follow the steps in theAdding a Test Card Numbersection.

- Using theRESTAPI, send Apple Pay transaction requests to the test endpoints.

ADDITIONAL INFORMATION

Refer to the tasks in Processing Apple Pay Transactions. - Adjust your integration settings as needed until your test transactions complete successfully.

RESULT

You can now proceed to Integrating Apple Pay into Your Production Environment.

Integrating Apple Pay into Your Production Environment

After you validate Apple Pay in your test environment,

you can integrate Apple Pay into your production environment.

- Follow these steps to integrate Apple Pay into your production environment:

- Use your Apple merchant ID to generate a certificate signing request (CSR) and create aproductionApple Pay payment processing certificate.

ADDITIONAL INFORMATION

- If you offer your customers Apple Pay on the Web, perform the additional setup steps for your production environment.

ADDITIONAL INFORMATION

RESULT

You can now proceed to

Processing Apple Pay Transactions.

Processing Apple Pay Transactions

Visa Acceptance Solutions

- Authorize an Apple Pay payment withdecryptionVisa Acceptance Solutions

- Authorize an Apple Pay payment with merchant decryption

- Process an Apple Pay sale withdecryptionVisa Acceptance Solutions

- Process an Apple Pay sale with merchant decryption

- Reverse the authorization of an Apple Pay payment

- Capture an authorized Apple Pay payment

For each task in this section,

the example request message includes the

API field set to

processingInformation. paymentSolution

REST

001

.

This value identifies Apple Pay as the digital payment solution.IMPORTANT

In response to your successful payment authorization request,

Apple Pay returns an encrypted payload that contains sensitive payment

information. The method you use to extract and decrypt the payment data depends

on how you integrated Apple Pay into your system.

For high-level descriptions of the

decryption method and the merchant decryption method,

see Integration Options.

Visa Acceptance Solutions

Authorize an Apple Pay Payment with Visa Acceptance Solutions Decryption

Visa Acceptance Solutions

The topics in this section shows you how to authorize an Apple Pay payment transaction

with the decryption implementation of Apple Pay.

Visa Acceptance Solutions

IMPORTANT

In the example, the payment being authorized

was made using a .

Visa card

,

and the processor is

Visa Platform Connect

For information about cards, see

Cards Supported for Apple Pay on Visa Platform Connect.

Visa Acceptance Solutions

supports the Visa Platform Connect

processor.For general information about basic authorizations, see the "Standard

Payments Processing" section of the .

Basic Steps: Authorizing a Payment with Visa Acceptance Solutions Decryption

Visa Acceptance Solutions

Follow these steps to request an Apple Pay payment authorization with decryption:

Visa Acceptance Solutions

- Create the request message with the requiredRESTAPI fields.

- Use the API fields listed in Fields Required to Authorize a Payment with Visa Acceptance Solutions Decryption.

- Refer to the example in REST Example: Authorize a Payment with Visa Acceptance Solutions Decryption.

- Send the message to one of these endpoints:

- Production:POSThttps://api.visaacceptance.com/pts/v2/payments

- Test:POSThttps://apitest.visaacceptance.com/pts/v2/payments

- Verify the response messages to make sure that the request was successful.

ADDITIONAL INFORMATION

A 200-level HTTP response code indicates success. See the .

Fields Required to Authorize a Payment with Visa Acceptance Solutions Decryption

Visa Acceptance Solutions

As a best practice,

include these

decryption implementation of Apple Pay.

REST API

fields

in your request for an authorization transaction with the

Visa Acceptance Solutions

Depending on your processor, your geographic location, and whether

the relaxed address verification system (RAVS) is enabled for your account,

some of these fields might not be required.

It is your responsibility to determine whether an API field can be omitted

from the transaction you are requesting.

For information about the relaxed requirements for address data and expiration

dates in payment transactions, see the .- clientReferenceInformation.code

- orderInformation.amountDetails.currency

- orderInformation.amountDetails.totalAmount

- orderInformation.billTo.address1

- orderInformation.billTo.administrativeArea

- orderInformation.billTo.country

- orderInformation.billTo.email

- orderInformation.billTo.firstName

- orderInformation.billTo.lastName

- orderInformation.billTo.locality

- orderInformation.billTo.postalCode

- paymentInformation.fluidData.descriptor

- Format of the encrypted payment data.

- Set the value toRklEPUNPTU1PTi5BUFBMRS5JTkFQUC5QQVlNRU5Ufor Apple Pay.

- paymentInformation.fluidData.encoding

- Encoding method used to encrypt the payment data.

- Set the value toBase64for Apple Pay.

- paymentInformation.fluidData.value

- Set the value to the encrypted payment data value returned by the Full Wallet request.

- processingInformation.paymentSolution

- Set the value to001to identify Apple Pay as the digital payment solution.

REST Example: Authorize a Payment with Visa Acceptance Solutions Decryption

Visa Acceptance Solutions

Request

{ "clientReferenceInformation": { "code": "TC_1231223" }, "processingInformation": { "paymentSolution": "001" }, "orderInformation": { "amountDetails": { "totalAmount": "10", "currency": "USD" }, "billTo": { "firstName": "John", "lastName": "Doe", "address1": "901 Metro Center Blvd", "locality": "Foster City", "administrativeArea": "CA", "postalCode": "94404", "country": "US", "email": "[email protected]" } }, "paymentInformation": { "fluidData": { "value": "eyJkYXRhIjoiXC9NK2VQQ0JlMmtod1pMQkFzRWhneHFqYXF2MmtZNDJSNnd1VDdnT3JlelBwRE9hR2dmc1AzZUNHZUplSjFSc3JpSERGSnJIK0FJVHp6RFdjVXNHUlNuSER3QlBcL2JHakU0dUhYcTFDOXFjWDBLWmYzaTFZNkV2b1wvaXExOFhkcG5obTI1U2kwSGpkWUJGRmVBUmZlVENpMEtDSGtRN04wZTAyeElRbm84Qmt1TVwvSUQ5bHdoNXBFVnVYM08ybjc4bHVyU0tlRmpXVHMyWG9Pc1pmWXBpbFQ4ZFFtK2RaYmh6VHgyZ2hMXC9FcFBReUVvdW5QTFZjTlwvaTR0blFnakxWRWJiNUFDNHJ4ZjBwK2M0VGtYSzcycGZGY05NSnlxd0RlQWZ2cHB6cnFQZVdoaWlpdzUwTmljT3duR29tcXA0bWU2anV4S2N5ZFh3cGpJR3BhQlBuXC9NY3o2d2ZDSFAzMWY1NHdkRmZ4bEZadjl5XC85aGw5YlY1d08yN2R5bFwvYUVxN2FYbU5JZHBQNTFsOXlSQlUzNDNYcjR3XC9MSXN2ZmZTTE91WDlsRU5QUGtocE1LUXo4VWpYNG0xXC9xazdcL256aGFSekFaZGh6VGZsNkZ3PT0iLCJ2ZXJzaW9uIjoiRUNfdjEiLCJoZWFkZXIiOnsiYXBwbGljYXRpb25EYXRhIjoiNDE3MDcwNkM2OTYzNjE3NDY5NkY2RTQ0NjE3NDYxIiwidHJhbnNhY3Rpb25JZCI6IjU0NzI2MTZFNzM2MTYzNzQ2OTZGNkU0OTQ0IiwiZXBoZW1lcmFsUHVibGljS2V5IjoiTUlJQlN6Q0NBUU1HQnlxR1NNNDlBZ0V3Z2ZjQ0FRRXdMQVlIS29aSXpqMEJBUUloQVBcL1wvXC9cLzhBQUFBQkFBQUFBQUFBQUFBQUFBQUFcL1wvXC9cL1wvXC9cL1wvXC9cL1wvXC9cL1wvXC9cL01Gc0VJUFwvXC9cL1wvOEFBQUFCQUFBQUFBQUFBQUFBQUFBQVwvXC9cL1wvXC9cL1wvXC9cL1wvXC9cL1wvXC9cLzhCQ0JheGpYWXFqcVQ1N1BydlZWMm1JYThaUjBHc014VHNQWTd6ancrSjlKZ1N3TVZBTVNkTmdpRzV3U1RhbVo0NFJPZEpyZUJuMzZRQkVFRWF4ZlI4dUVzUWtmNHZPYmxZNlJBOG5jRGZZRXQ2ek9nOUtFNVJkaVl3cFpQNDBMaVwvaHBcL200N242MHA4RDU0V0s4NHpWMnN4WHM3THRrQm9ONzlSOVFJaEFQXC9cL1wvXC84QUFBQUFcL1wvXC9cL1wvXC9cL1wvXC9cLys4NXZxdHB4ZWVoUE81eXNMOFl5VlJBZ0VCQTBJQUJPSnZpNkxGa0JpUTJINDR6K05VK0I3N1hZV2p4UHJQaXRDMFRWZytJYnNGeXIrNjFsemFkQjFrU25hUHpFTmVMMEVrbzhWTExzVjRhU1hTalwvZXlJRmc9IiwicHVibGljS2V5SGFzaCI6IlwvNkxQT3BoS0tydWFvdjBET3VOTDk1YXFCcFVcLzArNElXNXFhV3FxME5qRT0ifSwic2lnbmF0dXJlIjoiTUlJRFFnWUpLb1pJaHZjTkFRY0NvSUlETXpDQ0F5OENBUUV4Q3pBSkJnVXJEZ01DR2dVQU1Bc0dDU3FHU0liM0RRRUhBYUNDQWlzd2dnSW5NSUlCbEtBREFnRUNBaEJjbCtQZjMrVTRwazEzblZEOW53UVFNQWtHQlNzT0F3SWRCUUF3SnpFbE1DTUdBMVVFQXg0Y0FHTUFhQUJ0QUdFQWFRQkFBSFlBYVFCekFHRUFMZ0JqQUc4QWJUQWVGdzB4TkRBeE1ERXdOakF3TURCYUZ3MHlOREF4TURFd05qQXdNREJhTUNjeEpUQWpCZ05WQkFNZUhBQmpBR2dBYlFCaEFHa0FRQUIyQUdrQWN3QmhBQzRBWXdCdkFHMHdnWjh3RFFZSktvWklodmNOQVFFQkJRQURnWTBBTUlHSkFvR0JBTkM4K2tndGdtdldGMU96amdETnJqVEVCUnVvXC81TUt2bE0xNDZwQWY3R3g0MWJsRTl3NGZJWEpBRDdGZk83UUtqSVhZTnQzOXJMeXk3eER3YlwvNUlrWk02MFRaMmlJMXBqNTVVYzhmZDRmek9wazNmdFphUUdYTkxZcHRHMWQ5VjdJUzgyT3VwOU1NbzFCUFZyWFRQSE5jc005OUVQVW5QcWRiZUdjODdtMHJBZ01CQUFHalhEQmFNRmdHQTFVZEFRUlJNRStBRUhaV1ByV3RKZDdZWjQzMWhDZzdZRlNoS1RBbk1TVXdJd1lEVlFRREhod0FZd0JvQUcwQVlRQnBBRUFBZGdCcEFITUFZUUF1QUdNQWJ3QnRnaEJjbCtQZjMrVTRwazEzblZEOW53UVFNQWtHQlNzT0F3SWRCUUFEZ1lFQWJVS1lDa3VJS1M5UVEybUZjTVlSRUltMmwrWGc4XC9KWHYrR0JWUUprT0tvc2NZNGlOREZBXC9iUWxvZ2Y5TExVODRUSHdOUm5zdlYzUHJ2N1JUWTgxZ3EwZHRDOHpZY0FhQWtDSElJM3lxTW5KNEFPdTZFT1c5a0prMjMyZ1NFN1dsQ3RIYmZMU0tmdVNnUVg4S1hRWXVaTGsyUnI2M044QXBYc1h3QkwzY0oweGdlQXdnZDBDQVFFd096QW5NU1V3SXdZRFZRUURIaHdBWXdCb0FHMEFZUUJwQUVBQWRnQnBBSE1BWVFBdUFHTUFid0J0QWhCY2wrUGYzK1U0cGsxM25WRDlud1FRTUFrR0JTc09Bd0lhQlFBd0RRWUpLb1pJaHZjTkFRRUJCUUFFZ1lDZ2RvN2lrTzdERTNCXC9pY0lycmRjc1ZIanJyQmNPdXNndXhlcGs1QW41ZEExV01rajBlVjRsMVM0RnR5NktwdlR0T0xcL3VSdDhuTHZpVnR0TVVSZHBYTjNWXC9NVmZnVkxlXC9YUm5cLzRzbUJnMVgweE5OTXlTZXBQalVxV1ZkWFg1K0RWYnp2U0ZKSVJGdmt1MHJPaGg3REZmODVpbXNkaGRZRUhCaUg0TzdpK1E9PSJ9", "descriptor": "RklEPUNPTU1PTi5BUFBMRS5JTkFQUC5QQVlNRU5U", "encoding": "Base64" } } }

Response to a Successful Request

{ "_links": { "authReversal": { "method": "POST", "href": "/pts/v2/payments/7359642011156554503954/reversals" }, "self": { "method": "GET", "href": "/pts/v2/payments/7359642011156554503954" }, "capture": { "method": "POST", "href": "/pts/v2/payments/7359642011156554503954/captures" } }, "clientReferenceInformation": { "code": "TC_1231223" }, "consumerAuthenticationInformation": { "token": "Axj/7wSTjveM2Bej4NcSABsY1aQodZpGb2Y8uGnvx4dJq4Cnvx4dJq+kCvoTi4ZNJMvRiuIkVgTk473jNgXo+DXEgAAAkQmH" }, "id": "7359642011156554503954", "issuerInformation": { "responseRaw": "0110322000000E1000020000000000000010000104041641840132353442435634463759474B433833313030303030000159008000223134573031363135303730333830323039344730363400103232415050524F56414C00065649435243200034544B54523031313132313231323132313231544C3030323636504E30303431313131" }, "orderInformation": { "amountDetails": { "authorizedAmount": "10.00", "currency": "USD" } }, "paymentAccountInformation": { "card": { "type": "001" } }, "paymentInformation": { "tokenizedCard": { "expirationYear": "2025", "requestorId": "12121212121", "prefix": "411111", "assuranceLevel": "66", "expirationMonth": "07", "suffix": "1111", "type": "001" }, "card": { "suffix": "1111", "type": "001" } }, "pointOfSaleInformation": { "terminalId": "02495701" }, "processingInformation": { "paymentSolution": "001" }, "processorInformation": { "merchantNumber": "000372839590885", "approvalCode": "831000", "networkTransactionId": "016150703802094", "transactionId": "016150703802094", "responseCode": "00", "avs": { "code": "Y", "codeRaw": "Y" } }, "reconciliationId": "54BCV4F7YGKC", "riskInformation": { "earlyVelocity": { "counts": [ { "count": "1", "informationCode": "MVEL-R1" } ] } }, "status": "AUTHORIZED", "submitTimeUtc": "2025-01-04T04:16:42Z" }

Authorize an Apple Pay Payment with Merchant Decryption

The topics in this section shows you how to authorize an Apple Pay payment transaction

with the

merchant decryption

implementation of Apple Pay.IMPORTANT

In the example, the payment being authorized

was made using a .

Visa card

,

and the processor is

Visa Platform Connect

For information about cards, see

Cards Supported for Apple Pay on Visa Platform Connect.

Visa Acceptance Solutions

supports the Visa Platform Connect

processor.For general information about basic authorizations, see the "Standard

Payments Processing" section of the .

Basic Steps: Authorizing a Payment with Merchant Decryption

- Follow these steps to request an Apple Pay payment authorization with merchant decryption:

- Create the request message with the requiredRESTAPI fields.

- Use the API fields listed in Fields Required to Authorize a Payment with Merchant Decryption.

- Refer to the example in REST Example: Authorize a Payment with Merchant Decryption.

- Send the message to one of these endpoints:

- Production:POSThttps://api.visaacceptance.com/pts/v2/payments

- Test:POSThttps://apitest.visaacceptance.com/pts/v2/payments

- Verify the response messages to make sure that the request was successful.

ADDITIONAL INFORMATION

A 200-level HTTP response code indicates success. See the .

Fields Required to Authorize a Payment with Merchant Decryption

As a best practice,

include these

decryption implementation of Apple Pay.

REST API

fields

in your request for an authorization transaction with the

Visa Acceptance Solutions

Depending on your processor, your geographic location, and whether

the relaxed address verification system (RAVS) is enabled for your account,

some of these fields might not be required.

It is your responsibility to determine whether an API field can be omitted

from the transaction you are requesting.

For information about the relaxed requirements for address data and expiration

dates in payment transactions, see the .- clientReferenceInformation.code

- orderInformation.amountDetails.currency

- orderInformation.amountDetails.totalAmount

- orderInformation.billTo.address1

- orderInformation.billTo.administrativeArea

- orderInformation.billTo.country

- orderInformation.billTo.email

- orderInformation.billTo.firstName

- orderInformation.billTo.lastName

- orderInformation.billTo.locality

- orderInformation.billTo.postalCode

- paymentInformation.tokenizedCard.cryptogram

- Token authentication verification value cryptogram.

- The value for this field must be a 28-character, Base64-encoded string (the encoding method for Apple Pay transactions).

- paymentInformation.tokenizedCard.expirationMonth

- Set the value to month in which the token expires. Format:MMPossible values:01through12.

- paymentInformation.tokenizedCard.expirationYear

- Set the value to the year in which the token expires. Format:yyyy.

- paymentInformation.tokenizedCard.number

- Set the value to customer's payment network token value that contains the customer's credit card number.

- ForVisa Platform Connect, set this field to the value that indicates the type of transaction that provided the payment network token data. Possible values:

- 1: In-app transaction.

- 2: Near-field communication (NFC) transaction. The customer’s mobile device provided the token data for a contactless EMV transaction.

- 3: A transaction using stored customer credentials onVisa Platform Connect, whether for merchant-initiated transactions (MITs) or customer-initiated transactions (CITs).

- IMPORTANTThis value does not specify the token service provider. It specifies the entity that provided you with information about the token.

- paymentInformation.tokenizedCard.type

- Three-digit value that indicates the card type. Possible values:

- 001: Visa

- 002: Mastercard

- 003: American Express

- 004: Discover

- 005: Diners Club

- 007: JCB

- 062: China UnionPay

- processingInformation.commerceIndicator

- Type of transaction. Some payment card companies use this information when determining discount rates. Possible values:

- aesk: American Express SafeKey authentication.

- dipb: Discover card type.

- internet: Default value for authorizations. E-commerce order placed from a website.

- js: JCB J/Secure authentication.

- spa: Mastercard Identity Check authentication.

- vbv: Visa Secure authentication

- processingInformation.paymentSolution

- Set the value to001to identify Apple Pay as the digital payment solution.

REST Example: Authorize a Payment with Merchant

Decryption

Request

{ "clientReferenceInformation": { "code": "TC_1231223" }, "processingInformation": { "commerceIndicator": "internet", "paymentSolution": "001" }, "paymentInformation": { "tokenizedCard": { "number": "4111111111111111", "expirationMonth": "12", "expirationYear": "2031", "cryptogram": "AceY+igABPs3jdwNaDg3MAACAAA=", "transactionType": "1", "type": "001" } }, "orderInformation": { "amountDetails": { "totalAmount": "10", "currency": "USD" }, "billTo": { "firstName": "John", "lastName": "Doe", "address1": "901 Metro Center Blvd", "locality": "Foster City", "administrativeArea": "CA", "postalCode": "94404", "country": "US", "email": "[email protected]" } } }

Response to a Successful Request

{ "_links": { "authReversal": { "method": "POST", "href": "/pts/v2/payments/7359621903916966603954/reversals" }, "self": { "method": "GET", "href": "/pts/v2/payments/7359621903916966603954" }, "capture": { "method": "POST", "href": "/pts/v2/payments/7359621903916966603954/captures" } }, "clientReferenceInformation": { "code": "TC_1231223" }, "id": "7359621903916966603954", "orderInformation": { "amountDetails": { "authorizedAmount": "10.00", "currency": "USD" } }, "paymentAccountInformation": { "card": { "type": "001" } }, "paymentInformation": { "tokenizedCard": { "expirationYear": "2031", "prefix": "411111", "expirationMonth": "12", "suffix": "1111", "type": "001" }, "card": { "type": "001" } }, "processingInformation": { "paymentSolution": "001" }, "processorInformation": { "systemTraceAuditNumber": "918032", "approvalCode": "831000", "merchantAdvice": { "code": "01", "codeRaw": "M001" }, "responseDetails": "ABC", "networkTransactionId": "016153570198200", "retrievalReferenceNumber": "500303918032", "consumerAuthenticationResponse": { "code": "2", "codeRaw": "2" }, "transactionId": "016153570198200", "responseCode": "00", "avs": { "code": "Y", "codeRaw": "Y" } }, "reconciliationId": "7359621903916966603954", "status": "AUTHORIZED", "submitTimeUtc": "2025-01-04T03:43:10Z" }

Process an Apple Pay Sale with Visa Acceptance Solutions Decryption

Visa Acceptance Solutions

The topics in this section shows you how to process an Apple Pay sale with the decryption implementation of Apple Pay.

Visa Acceptance Solutions

A sale bundles an authorization and capture in a single transaction. Request the

authorization and capture at the same time. The authorization and capture amounts must

be the same.

The

REST

API message for a sale request

is the same as the message for an authorization request,

except that the sale request message must set the

processingInformation.capture

field to

true

.IMPORTANT

In the example, the sale transaction

is made using a .

Visa card

,

and the processor is

Visa Platform Connect

For information about cards, see

Cards Supported for Apple Pay on Visa Platform Connect.

Visa Acceptance Solutions

supports the Visa Platform Connect

processor.For general information about sale transactions, see the "Standard

Payments Processing" section of the .

Basic Steps: Processing a Sale with Visa Acceptance Solutions Decryption

Visa Acceptance Solutions

- Follow these steps to process an Apple Pay sale transaction withdecryption:Visa Acceptance Solutions

- Create the request message with the requiredRESTAPI fields.

- Use the API fields listed in Fields Required to Process a Sale with Visa Acceptance Solutions Decryption.

- Refer to the example in REST Example: Process a Sale with Visa Acceptance Solutions Decryption.

- Send the message to one of these endpoints:

- Production:POSThttps://api.visaacceptance.com/pts/v2/payments

- Test:POSThttps://apitest.visaacceptance.com/pts/v2/payments

- Verify the response messages to make sure that the request was successful.

ADDITIONAL INFORMATION

A 200-level HTTP response code indicates success. See the .

Fields Required to Process a Sale with Visa Acceptance Solutions Decryption

Visa Acceptance Solutions

As a best practice,

include these

decryption implementation of Apple Pay.

REST API

fields

in your request for a combined authorization and capture (sale) transaction with the

Visa Acceptance Solutions

Depending on your processor, your geographic location, and whether

the relaxed address verification system (RAVS) is enabled for your account,

some of these fields might not be required.

It is your responsibility to determine whether an API field can be omitted

from the transaction you are requesting.

For information about the relaxed requirements for address data and expiration

dates in payment transactions, see the .- clientReferenceInformation.code

- orderInformation.amountDetails.currency

- orderInformation.amountDetails.totalAmount

- orderInformation.billTo.address1

- orderInformation.billTo.administrativeArea

- orderInformation.billTo.country

- orderInformation.billTo.email

- orderInformation.billTo.firstName

- orderInformation.billTo.lastName

- orderInformation.billTo.locality

- orderInformation.billTo.postalCode

- paymentInformation.fluidData.descriptor

- Format of the encrypted payment data.

- Set the value toRklEPUNPTU1PTi5BUFBMRS5JTkFQUC5QQVlNRU5Ufor Apple Pay.

- paymentInformation.fluidData.encoding

- Encoding method used to encrypt the payment data.

- Set the value toBase64for Apple Pay.

- paymentInformation.fluidData.value

- Set the value to the encrypted payment data value returned by the Full Wallet request.

- processingInformation.capture

- Set the value totruefor a sale transaction (to include a capture with the authorization).

- processingInformation.paymentSolution

- Set the value to001to identify Apple Pay as the digital payment solution.

REST Example: Process a Sale with Visa Acceptance Solutions Decryption

Visa Acceptance Solutions

Request

{ "clientReferenceInformation": { "code": "TC_1231223" }, "processingInformation": { "paymentSolution": "001", "capture": true }, "orderInformation": { "amountDetails": { "totalAmount": "10", "currency": "USD" }, "billTo": { "firstName": "John", "lastName": "Doe", "address1": "901 Metro Center Blvd", "locality": "Foster City", "administrativeArea": "CA", "postalCode": "94404", "country": "US", "email": [email protected] } }, "paymentInformation": { "fluidData": { "value": "eyJkYXRhIjoiXC9NK2VQQ0JlMmtod1pMQkFzRWhneHFqYXF2MmtZNDJSNnd1VDdnT3JlelBwRE9hR2dmc1AzZUNHZUplSjFSc3JpSERGSnJIK0FJVHp6RFdjVXNHUlNuSER3QlBcL2JHakU0dUhYcTFDOXFjWDBLWmYzaTFZNkV2b1wvaXExOFhkcG5obTI1U2kwSGpkWUJGRmVBUmZlVENpMEtDSGtRN04wZTAyeElRbm84Qmt1TVwvSUQ5bHdoNXBFVnVYM08ybjc4bHVyU0tlRmpXVHMyWG9Pc1pmWXBpbFQ4ZFFtK2RaYmh6VHgyZ2hMXC9FcFBReUVvdW5QTFZjTlwvaTR0blFnakxWRWJiNUFDNHJ4ZjBwK2M0VGtYSzcycGZGY05NSnlxd0RlQWZ2cHB6cnFQZVdoaWlpdzUwTmljT3duR29tcXA0bWU2anV4S2N5ZFh3cGpJR3BhQlBuXC9NY3o2d2ZDSFAzMWY1NHdkRmZ4bEZadjl5XC85aGw5YlY1d08yN2R5bFwvYUVxN2FYbU5JZHBQNTFsOXlSQlUzNDNYcjR3XC9MSXN2ZmZTTE91WDlsRU5QUGtocE1LUXo4VWpYNG0xXC9xazdcL256aGFSekFaZGh6VGZsNkZ3PT0iLCJ2ZXJzaW9uIjoiRUNfdjEiLCJoZWFkZXIiOnsiYXBwbGljYXRpb25EYXRhIjoiNDE3MDcwNkM2OTYzNjE3NDY5NkY2RTQ0NjE3NDYxIiwidHJhbnNhY3Rpb25JZCI6IjU0NzI2MTZFNzM2MTYzNzQ2OTZGNkU0OTQ0IiwiZXBoZW1lcmFsUHVibGljS2V5IjoiTUlJQlN6Q0NBUU1HQnlxR1NNNDlBZ0V3Z2ZjQ0FRRXdMQVlIS29aSXpqMEJBUUloQVBcL1wvXC9cLzhBQUFBQkFBQUFBQUFBQUFBQUFBQUFcL1wvXC9cL1wvXC9cL1wvXC9cL1wvXC9cL1wvXC9cL01Gc0VJUFwvXC9cL1wvOEFBQUFCQUFBQUFBQUFBQUFBQUFBQVwvXC9cL1wvXC9cL1wvXC9cL1wvXC9cL1wvXC9cLzhCQ0JheGpYWXFqcVQ1N1BydlZWMm1JYThaUjBHc014VHNQWTd6ancrSjlKZ1N3TVZBTVNkTmdpRzV3U1RhbVo0NFJPZEpyZUJuMzZRQkVFRWF4ZlI4dUVzUWtmNHZPYmxZNlJBOG5jRGZZRXQ2ek9nOUtFNVJkaVl3cFpQNDBMaVwvaHBcL200N242MHA4RDU0V0s4NHpWMnN4WHM3THRrQm9ONzlSOVFJaEFQXC9cL1wvXC84QUFBQUFcL1wvXC9cL1wvXC9cL1wvXC9cLys4NXZxdHB4ZWVoUE81eXNMOFl5VlJBZ0VCQTBJQUJPSnZpNkxGa0JpUTJINDR6K05VK0I3N1hZV2p4UHJQaXRDMFRWZytJYnNGeXIrNjFsemFkQjFrU25hUHpFTmVMMEVrbzhWTExzVjRhU1hTalwvZXlJRmc9IiwicHVibGljS2V5SGFzaCI6IlwvNkxQT3BoS0tydWFvdjBET3VOTDk1YXFCcFVcLzArNElXNXFhV3FxME5qRT0ifSwic2lnbmF0dXJlIjoiTUlJRFFnWUpLb1pJaHZjTkFRY0NvSUlETXpDQ0F5OENBUUV4Q3pBSkJnVXJEZ01DR2dVQU1Bc0dDU3FHU0liM0RRRUhBYUNDQWlzd2dnSW5NSUlCbEtBREFnRUNBaEJjbCtQZjMrVTRwazEzblZEOW53UVFNQWtHQlNzT0F3SWRCUUF3SnpFbE1DTUdBMVVFQXg0Y0FHTUFhQUJ0QUdFQWFRQkFBSFlBYVFCekFHRUFMZ0JqQUc4QWJUQWVGdzB4TkRBeE1ERXdOakF3TURCYUZ3MHlOREF4TURFd05qQXdNREJhTUNjeEpUQWpCZ05WQkFNZUhBQmpBR2dBYlFCaEFHa0FRQUIyQUdrQWN3QmhBQzRBWXdCdkFHMHdnWjh3RFFZSktvWklodmNOQVFFQkJRQURnWTBBTUlHSkFvR0JBTkM4K2tndGdtdldGMU96amdETnJqVEVCUnVvXC81TUt2bE0xNDZwQWY3R3g0MWJsRTl3NGZJWEpBRDdGZk83UUtqSVhZTnQzOXJMeXk3eER3YlwvNUlrWk02MFRaMmlJMXBqNTVVYzhmZDRmek9wazNmdFphUUdYTkxZcHRHMWQ5VjdJUzgyT3VwOU1NbzFCUFZyWFRQSE5jc005OUVQVW5QcWRiZUdjODdtMHJBZ01CQUFHalhEQmFNRmdHQTFVZEFRUlJNRStBRUhaV1ByV3RKZDdZWjQzMWhDZzdZRlNoS1RBbk1TVXdJd1lEVlFRREhod0FZd0JvQUcwQVlRQnBBRUFBZGdCcEFITUFZUUF1QUdNQWJ3QnRnaEJjbCtQZjMrVTRwazEzblZEOW53UVFNQWtHQlNzT0F3SWRCUUFEZ1lFQWJVS1lDa3VJS1M5UVEybUZjTVlSRUltMmwrWGc4XC9KWHYrR0JWUUprT0tvc2NZNGlOREZBXC9iUWxvZ2Y5TExVODRUSHdOUm5zdlYzUHJ2N1JUWTgxZ3EwZHRDOHpZY0FhQWtDSElJM3lxTW5KNEFPdTZFT1c5a0prMjMyZ1NFN1dsQ3RIYmZMU0tmdVNnUVg4S1hRWXVaTGsyUnI2M044QXBYc1h3QkwzY0oweGdlQXdnZDBDQVFFd096QW5NU1V3SXdZRFZRUURIaHdBWXdCb0FHMEFZUUJwQUVBQWRnQnBBSE1BWVFBdUFHTUFid0J0QWhCY2wrUGYzK1U0cGsxM25WRDlud1FRTUFrR0JTc09Bd0lhQlFBd0RRWUpLb1pJaHZjTkFRRUJCUUFFZ1lDZ2RvN2lrTzdERTNCXC9pY0lycmRjc1ZIanJyQmNPdXNndXhlcGs1QW41ZEExV01rajBlVjRsMVM0RnR5NktwdlR0T0xcL3VSdDhuTHZpVnR0TVVSZHBYTjNWXC9NVmZnVkxlXC9YUm5cLzRzbUJnMVgweE5OTXlTZXBQalVxV1ZkWFg1K0RWYnp2U0ZKSVJGdmt1MHJPaGg3REZmODVpbXNkaGRZRUhCaUg0TzdpK1E9PSJ9", "descriptor": "RklEPUNPTU1PTi5BUFBMRS5JTkFQUC5QQVlNRU5U", "encoding": "Base64" } } }

Response to a Successful Request

{ "_links": { "void": { "method": "POST", "href": "/pts/v2/payments/7359641336126184303955/voids" }, "self": { "method": "GET", "href": "/pts/v2/payments/7359641336126184303955" } }, "clientReferenceInformation": { "code": "TC_1231223" }, "consumerAuthenticationInformation": { "token": "Axj//wSTjveKcificy1TABsQ3ZtGThq1Zp78eHSPSAp78eHSPTpAr6E4uGTSTL0YriJFQwJycd7xTkT8TmWqYAAAtQlD" }, "id": "7359641336126184303955", "issuerInformation": { "responseRaw": "0110322000000E1000020000000000000010000104041534840127353442435634463759474B373833313030303030000159008000223134573031363135303730333830323039344730363400103232415050524F56414C00065649435243200034544B54523031313132313231323132313231544C3030323636504E30303431313131" }, "orderInformation": { "amountDetails": { "totalAmount": "10.00", "authorizedAmount": "10.00", "currency": "USD" } }, "paymentAccountInformation": { "card": { "type": "001" } }, "paymentInformation": { "tokenizedCard": { "expirationYear": "2025", "requestorId": "12121212121", "prefix": "411111", "assuranceLevel": "66", "expirationMonth": "07", "suffix": "1111", "type": "001" }, "card": { "suffix": "1111", "type": "001" } }, "pointOfSaleInformation": { "terminalId": "02495701" }, "processingInformation": { "paymentSolution": "001" }, "processorInformation": { "merchantNumber": "000372839590885", "approvalCode": "831000", "networkTransactionId": "016150703802094", "transactionId": "016150703802094", "responseCode": "00", "avs": { "code": "Y", "codeRaw": "Y" } }, "reconciliationId": "73428553", "riskInformation": { "earlyVelocity": { "counts": [ { "count": "1", "informationCode": "MVEL-R1" } ] } }, "status": "AUTHORIZED", "submitTimeUtc": "2025-01-04T04:15:34Z" }

Process an Apple Pay Sale with Merchant Decryption

The topics in this section shows you how to process an Apple Pay sale with the

merchant decryption

implementation of Apple Pay.A sale bundles an authorization and capture in a single transaction. Request the

authorization and capture at the same time. The authorization and capture amounts must

be the same.

The

REST

API message for a sale request

is the same as the message for an authorization request,

except that the sale request message must set the

processingInformation.capture

field to

true

.IMPORTANT

In the example, the sale transaction

is made using a .

Visa card

,

and the processor is

Visa Platform Connect

For information about cards, see

Cards Supported for Apple Pay on Visa Platform Connect.

Visa Acceptance Solutions

supports the Visa Platform Connect

processor.For general information about sale transactions, see the "Standard

Payments Processing" section of the .

Basic Steps: Processing a Sale with Merchant Decryption

- Follow these steps to process an Apple Pay sale transaction with merchant decryption:

- Create the request message with the requiredRESTAPI fields.

- Use the API fields listed in Fields Required to Process a Sale with Merchant Decryption.

- Refer to the example in REST Example: Process a Sale with Merchant Decryption.

- Send the message to one of these endpoints:

- Production:POSThttps://api.visaacceptance.com/pts/v2/payments

- Test:POSThttps://apitest.visaacceptance.com/pts/v2/payments

- Verify the response messages to make sure that the request was successful.

ADDITIONAL INFORMATION

A 200-level HTTP response code indicates success. See the .

Fields Required to Process a Sale with Merchant Decryption

As a best practice,

include these

decryption implementation of Apple Pay.

REST API

fields

in your request for a combined authorization and capture (sale) transaction with the

Visa Acceptance Solutions

Depending on your processor, your geographic location, and whether

the relaxed address verification system (RAVS) is enabled for your account,

some of these fields might not be required.

It is your responsibility to determine whether an API field can be omitted

from the transaction you are requesting.

For information about the relaxed requirements for address data and expiration

dates in payment transactions, see the .- clientReferenceInformation.code

- orderInformation.amountDetails.currency

- orderInformation.amountDetails.totalAmount

- orderInformation.billTo.address1

- orderInformation.billTo.administrativeArea

- orderInformation.billTo.country

- orderInformation.billTo.email

- orderInformation.billTo.firstName

- orderInformation.billTo.lastName

- orderInformation.billTo.locality

- orderInformation.billTo.postalCode

- paymentInformation.tokenizedCard.cryptogram

- Token authentication verification value cryptogram.

- The value for this field must be a 28-character, Base64-encoded string (the encoding method for Apple Pay transactions).

- paymentInformation.tokenizedCard.expirationMonth

- Set the value to month in which the token expires. Format:MMPossible values:01through12.

- paymentInformation.tokenizedCard.expirationYear

- Set the value to the year in which the token expires. Format:yyyy.

- paymentInformation.tokenizedCard.number

- Set the value to customer's payment network token value that contains the customer's credit card number.

- ForVisa Platform Connect, set this field to the value that indicates the type of transaction that provided the payment network token data. Possible values:

- 1: In-app transaction.

- 2: Near-field communication (NFC) transaction. The customer’s mobile device provided the token data for a contactless EMV transaction.

- 3: A transaction using stored customer credentials onVisa Platform Connect, whether for merchant-initiated transactions (MITs) or customer-initiated transactions (CITs).

- IMPORTANTThis value does not specify the token service provider. It specifies the entity that provided you with information about the token.

- paymentInformation.tokenizedCard.type

- Three-digit value that indicates the card type. Possible values:

- 001: Visa

- 002: Mastercard

- 003: American Express

- 004: Discover

- 005: Diners Club

- 007: JCB

- 062: China UnionPay

- processingInformation.capture

- Set the value totrueto include a capture with the authorization.

- processingInformation.commerceIndicator

- Type of transaction. Some payment card companies use this information when determining discount rates. Possible values:

- aesk: American Express SafeKey authentication.

- dipb: Discover card type.

- internet: Default value for authorizations. E-commerce order placed from a website.

- js: JCB J/Secure authentication.

- spa: Mastercard Identity Check authentication.

- vbv: Visa Secure authentication

- processingInformation.paymentSolution

- Set the value to001to identify Apple Pay as the digital payment solution.

REST Example: Process a Sale with Merchant Decryption

Request

{ "clientReferenceInformation": { "code": "TC_1231223" }, "processingInformation": { "commerceIndicator": "internet", "paymentSolution": "001", "capture": true }, "paymentInformation": { "tokenizedCard": { "number": "4111111111111111", "expirationMonth": "12", "expirationYear": "2031", "cryptogram": "AceY+igABPs3jdwNaDg3MAACAAA=", "transactionType": "1", "type": "001" } }, "orderInformation": { "amountDetails": { "totalAmount": "10", "currency": "USD" }, "billTo": { "firstName": "John", "lastName": "Doe", "address1": "901 Metro Center Blvd", "locality": "Foster City", "administrativeArea": "CA", "postalCode": "94404", "country": "US", "email": "[email protected]" } } }

Response to a Successful Request

{ "_links": { "void": { "method": "POST", "href": "/pts/v2/payments/7359627932726161403954/voids" }, "self": { "method": "GET", "href": "/pts/v2/payments/7359627932726161403954" } }, "clientReferenceInformation": { "code": "TC_1231223" }, "id": "7359627932726161403954", "orderInformation": { "amountDetails": { "totalAmount": "10.00", "authorizedAmount": "10.00", "currency": "USD" } }, "paymentAccountInformation": { "card": { "type": "001" } }, "paymentInformation": { "tokenizedCard": { "expirationYear": "2031", "prefix": "411111", "expirationMonth": "12", "suffix": "1111", "type": "001" }, "card": { "type": "001" } }, "processingInformation": { "paymentSolution": "001" }, "processorInformation": { "systemTraceAuditNumber": "417802", "approvalCode": "831000", "merchantAdvice": { "code": "01", "codeRaw": "M001" }, "responseDetails": "ABC", "networkTransactionId": "016153570198200", "retrievalReferenceNumber": "500303417802", "consumerAuthenticationResponse": { "code": "2", "codeRaw": "2" }, "transactionId": "016153570198200", "responseCode": "00", "avs": { "code": "Y", "codeRaw": "Y" } }, "reconciliationId": "7359627932726161403954", "status": "AUTHORIZED", "submitTimeUtc": "2025-01-04T03:53:13Z" }

Reverse an Apple Pay Payment Authorization

The topics in this section shows you how to reverse an Apple Pay payment

authorization.

IMPORTANT

In the example, the authorization being reversed

is for a payment made using a .

Visa card

,

and the processor is

Visa Platform Connect

For information about cards, see

Cards Supported for Apple Pay on Visa Platform Connect.

Visa Acceptance Solutions

supports the Visa Platform Connect

processor.For general information about authorization reversals, see the

"Standard Payments Processing" section of the .

Basic Steps: Reversing a Payment Authorization

- Follow these steps to reverse an Apple Pay payment authorization:

- Create the request message with the requiredRESTAPI fields.

- Use the API fields listed in Fields Required to Reverse a Payment Authorization.

- Refer to the example in REST Example: Reverse a Payment Authorization.

- Send the request to one of these endpoints:

- Production:POSThttps://api.visaacceptance.com/pts/v2/payments/{id}/reversals

- Test:POSThttps://apitest.visaacceptance.com/pts/v2/payments/{id}/reversals

ADDITIONAL INFORMATION

Replace the{id}portion of the URL with the transaction ID of the payment that you want to reverse. The transaction ID is returned in theidfield of the response to the authorization request. Example value: 7359642011156554503954 - Verify the response messages to make sure that the request was successful.

ADDITIONAL INFORMATION

A 200-level HTTP response code indicates success. See the .

Fields Required to Reverse a Payment Authorization

As a best practice,

include these

REST API

fields

in your request to reverse the authorization of an Apple Pay transaction.Depending on your processor, your geographic location, and whether

the relaxed address verification system (RAVS) is enabled for your account,

some of these fields might not be required.

It is your responsibility to determine whether an API field can be omitted

from the transaction you are requesting.

For information about the relaxed requirements for address data and expiration

dates in payment transactions, see the .- clientReferenceInformation.code

- Set this field to the value returned in the response to the original authorization.

- orderInformation.amountDetails.currency

- processingInformation.paymentSolution

- Set the value to001to identify Apple Pay as the digital payment solution.

- reversalInformation.amountDetails.totalAmount

REST Example: Reverse a Payment Authorization

Request

{ "clientReferenceInformation": { "code": "TC_1231223" }, "processingInformation": { "paymentSolution": "001" }, "orderInformation": { "amountDetails": { "currency": "USD" } }, "reversalInformation": { "amountDetails": { "totalAmount": "10" } } }

Response to a Successful Request

{ "_links": { "void": { "method": "POST", "href": "/pts/v2/captures/6662994431376681303954/voids" }, "self": { "method": "GET", } }, "clientReferenceInformation": { "code": "TC_1231223" }, "id": "6662994431376681303954", "orderInformation": { "amountDetails": { "totalAmount": "10.00", "currency": "USD" } }, "reconciliationId": "66535942B9CGT52U", "status": "PENDING", "submitTimeUtc": "2025-01-04T23:56:13Z" }

Capture an Apple Pay Authorization

The topics in this section shows you how to capture an authorized Apple Pay payment

transaction.

IMPORTANT

In the example, the payment being captured

was made using a .

Visa card

,

and the transaction is processed with the

Visa Platform Connect

For information about cards, see

Cards Supported for Apple Pay on Visa Platform Connect.

Visa Acceptance Solutions

supports the Visa Platform Connect

processor.For general information about capture transactions, see the "Standard

Payments Processing" section of the .

Basic Steps: Capturing an Authorization

- Follow these steps to capture an authorized Apple Pay payment transaction:

- Create the request message with the requiredRESTAPI fields.

- Use the API fields listed in Fields Required to Capture an Authorization.

- Refer to the example in REST Example: Capturing an Authorization.

- Send the request to one of these endpoints:

- Production:POSThttps://api.visaacceptance.com/pts/v2/payments/{id}/captures

- Test:POSThttps://apitest.visaacceptance.com/pts/v2/payments/{id}/captures

ADDITIONAL INFORMATION

Replace the{id}portion of the URL with the transaction ID of the payment that you want to capture. The transaction ID is returned in theidfield of the response to the authorization request. Example value: 7359642011156554503954 - Verify the response messages to make sure that the request was successful.

ADDITIONAL INFORMATION

A 200-level HTTP response code indicates success. See the .

Fields Required to Capture an Authorization

As a best practice,

include these

REST API

fields

in your request to capture an authorized Apple Pay payment transaction.Depending on your processor, your geographic location, and whether

the relaxed address verification system (RAVS) is enabled for your account,

some of these fields might not be required.

It is your responsibility to determine whether an API field can be omitted

from the transaction you are requesting.

For information about the relaxed requirements for address data and expiration

dates in payment transactions, see the .- clientReferenceInformation.code

- Set this field to the value returned in the response to the original authorization.

- orderInformation.amountDetails.currency

- orderInformation.amountDetails.totalAmount

- processingInformation.paymentSolution

- Set the value to001to identify Apple Pay as the digital payment solution.

REST Example: Capturing an Authorization

Request

{ "clientReferenceInformation": { "code": "TC_1231223" }, "processingInformation": { "paymentSolution": "001" }, "orderInformation": { "amountDetails": { "totalAmount": "10", "currency": "USD" } } }

Response to a Successful Request

{ "_links": { "void": { "method": "POST", "href": "/pts/v2/captures/6662994431376681303954/voids" }, "self": { "method": "GET", } }, "clientReferenceInformation": { "code": "TC_1231223" }, "id": "6662994431376681303954", "orderInformation": { "amountDetails": { "totalAmount": "10.00", "currency": "USD" } }, "reconciliationId": "66535942B9CGT52U", "status": "PENDING", "submitTimeUtc": "2024-11-21T04:17:20Z" }

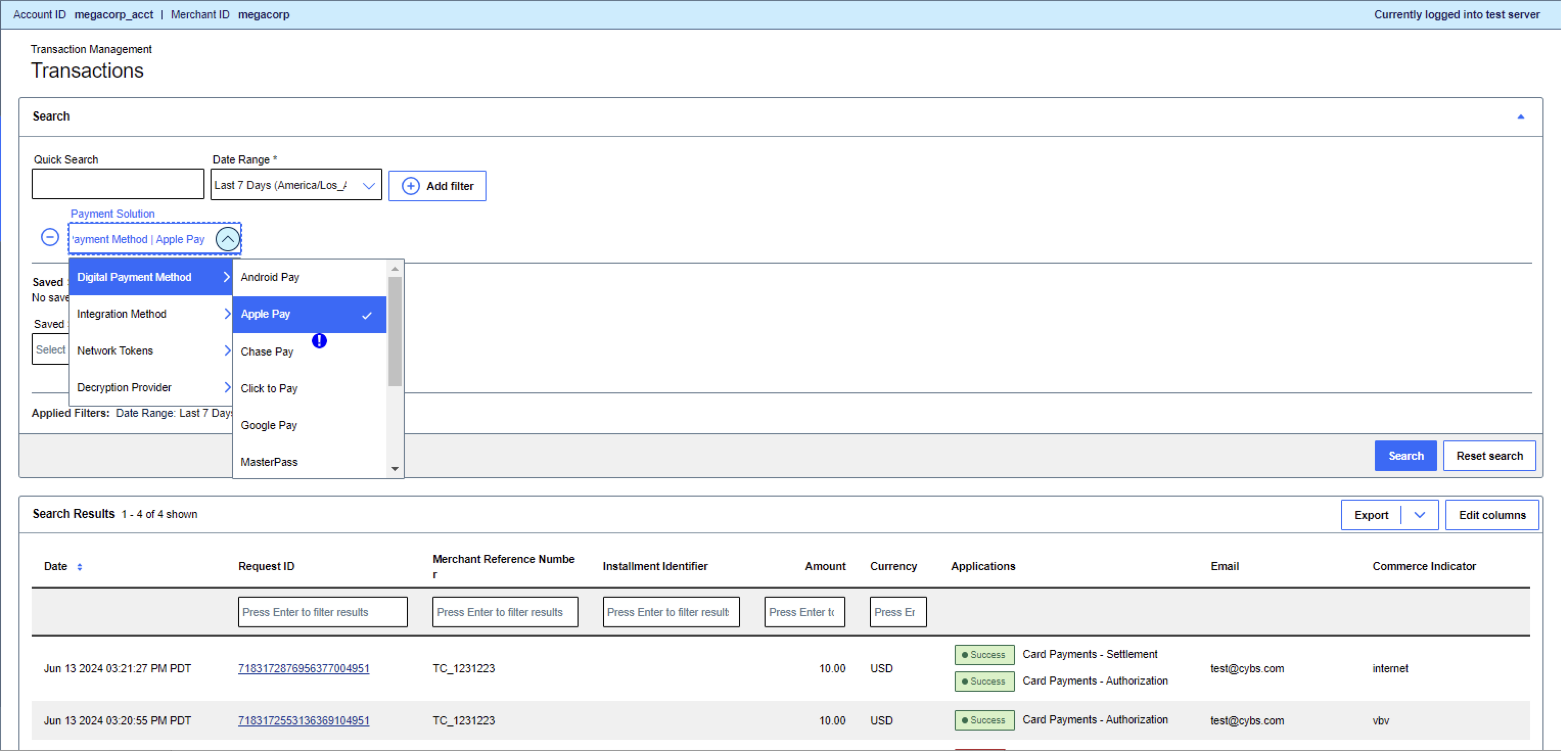

Searching for Transactions

Use the Transaction page in the

Business Center

to

search transactions that have been (successfully or unsuccessfully) processed on your

account or for one or more of your merchants. The page consists of a Search pane and a

Search Results pane.This section describes how to search

Apple Pay

transactions

using the Search pane in the Transactions page. IMPORTANT

For complete information about searching

all transactions

,

see the Search for Transactions topics in the Business Center

using the

Visa Acceptance Solutions

Transaction Management module You must have login

credentials to view the online help.Searching for Apple Pay Transactions

Use the Transactions page in the

Business Center

to search for Apple Pay transactions.Follow these steps to search for Apple Pay transactions:

- In the left navigation panel, click theTransaction Managementicon andTransactions.

- In the Transactions page, click Add Filter.